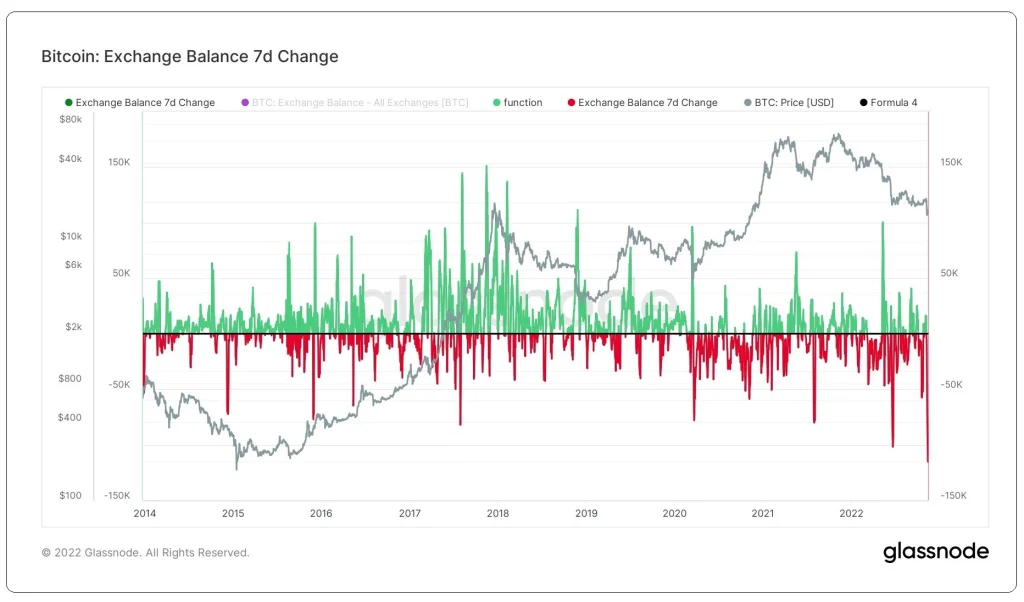

The crisis of confidence in centralized exchanges in the wake of the FTX scandal continues. According to research firm Glassnode, Bitcoin holders are withdrawing their coins to private wallets in record-breaking quantities. On a weekly basis this is the largest amount of coins ever.

This is usually interpreted as a reluctance to liquidate cryptocurrencies. Their holders deliberately place them for safekeeping where there is no possibility of immediate liquidation, unlike the coins in the exchanges. However, it is now clear that they are doing so more for protection. Lest they be caught off guard and cannot access their money, as happened with the FTX depositors.

Counterparty risk does not give warning. It does not leave much time for maneuvering as it usually occurs with great speed. Panics are as old as the markets. Trust takes time to build, but very quickly it can be eroded, even by a simple rumor. As in traditional banking, mass withdrawals are never made in euphoric conditions. They can, however, be made the next day. It’s a matter of hours.

The FTX scandal can be described as a (very expensive) lesson for cryptocurrency holders. The basic principle of Bitcoin’s philosophy from the beginning has been that you don’t need a custodian to hold your coins. One clever comment we read from cryptakias: “Exchanges should be used like a toilet. We go in, we do our job, we come out.”

The right exchanges don’t want to hold your bitcoin. They prefer that you keep them, in your own wallet. This tactic is safer for you and for them.

When a good idea is used for unethical purposes, it automatically turns bad. Sam Bankman-Fried used money he had embezzled from unsuspecting clients to influence (we’re being polite) politicians and regulators. He took advantage of his position to take unethical actions by acting irresponsibly.

FTX represents the opposite of the philosophy of the Bitcoin protocol. Bitcoin was created precisely to prevent Ponzi schemes, bank runs, Enron, Lehman Brothers, Bernie Madoff type scams. To eliminate the need for costly bailouts of the banking sector, whose management mistakes are paid for by poor citizens. To set the stage for a more efficient, fairer economic system that does not favour extreme inequalities.

The crypto ecosystem does not need to be bailed out by state funds. What it wants, as with all asset classes, is protection from fraudsters. But even without legal cover, after the current shakeout, the space will emerge stronger, more mature. The market will leave the toxic elements behind. Who today is dealing with Craig Wright or Roger Ver who were the star of the show in 2017? The same will happen with Sam Bankman-Fried (FTX), Do Kwon (Terra), Alex Mashinsky (Celsius).

There are more than a few who take advantage of the peculiarities of the industry and act irresponsibly, even unethically. To toxic participants it is good that the authorities put obstacles in their way.

So loud was the bankruptcy that we can take for granted the possibility that the intervention of the regulators will be accelerated and probably intensified. Ultimately the FTX scam in the long run will work in a positive way.

All that has been going on lately is noise. The ecosystem continues to evolve. When the car companies, the oil companies, the Internet were built, most people lost money. Many were cheated, others invested in companies that failed and perished. No one remembers these incidents, any more than they remember the money that was lost. What remained were the benefits of new technology that, despite the controversy, transformed the world. The same could possibly happen now.

As the industry grows, new players are entering. The difference until just a few years ago is staggering. Now cryptocurrency holders have reached triple-digit millions. They have turned their interest and capital to institutional investors and listed companies. States have legalized it and integrated it into their banking systems. There is daily coverage in global and recognized financial information networks. Conferences are held with the participation of celebrities in fancy locations.

Yes, but its price has been shattered, critics are shouting at the top of their voices. Indeed, it has indeed retreated a great deal.

But on this we ought to make three points:

- All assets at this time have fallen to record levels. Stocks, bonds, real estate, even cash. The reasons for this are many. The aftermath of the pandemic contributed to this: rising inflation, central bank tightening policies, disruption of the global supply chain, rising fuel costs, etc.

- Even now that Bitcoin is arguably in one of the worst moments in its history, at the height of the controversy, it is still running smoothly. Just as it was designed. Anyone still has the ability to send Bitcoin to anyone they wish, anywhere in the world, at any time. Unhindered by governments, bans, capital controls. In contrast, in times of crisis, the conventional monetary system collapses. You cannot receive or send or store money when banking institutions are not working, as in Lebanon, or if you are in a war zone, as in Ukraine, or if sanctions are imposed, as in Russia.

- The adoption of Bitcoin and despite the price fluctuations and the war it is undergoing, it continues its upward trend. Why? Because every day more and more people are becoming aware of the features that make Bitcoin unique. As an example, we see Glassnode’s data on addresses holding less than one Bitcoin (shrimp category). It is growing at a steady rate. A similar picture is shown in the 1 to 10 Bitcoin and 10 to 1,000 Bitcoin categories.

Previous Articles:

- Can You Pay Your Employees Using Crypto? Here’s What You Need To Know

- Is there a future for the cryptocurrency market without quantitative easing?

- Bahamas appoint PwC as FTX liquidators

- Liquid Exchange suspends cryptocurrency and fiat cash withdrawals due to FTX bankruptcy

- Warren Buffett’s “lieutenant” attacks cryptocurrencies