- Bitcoin maximalist Max Keiser predicts Gold-backed stablecoins will overtake USD-pegged alternatives globally.

- Russia, China, and Iran are unlikely to accept USD stablecoins, potentially favoring gold-backed alternatives instead.

- The trend conflicts with U.S. Treasury plans to use dollar-pegged stablecoins to maintain global financial dominance.

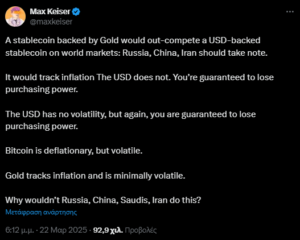

Gold-backed stablecoins could disrupt U.S. dollar dominance in global markets, according to prominent Bitcoin maximalist Max Keiser. He suggests that nations with adversarial relationships to the United States will reject dollar-pegged options in favor of gold-backed alternatives, challenging American financial hegemony.

Keiser argued that gold enjoys greater global trust than the U.S. dollar, particularly among nations with tense U.S. relations. His assessment directly challenges recent U.S. policy initiatives to maintain dollar dominance through stablecoin technology.

“Russia, China, and Iran are not going to accept a US dollar stablecoin. I predict they will counter the USD stablecoin with a Gold one. China and Russia have a combined 50,000 tonnes of Gold — more than what is reported,” Keiser stated.

This potential shift toward gold-backed digital assets represents a significant challenge to American financial influence, particularly as U.S. lawmakers develop frameworks to leverage stablecoins for extending dollar dominance internationally.

In June 2024, stablecoin issuer Tether launched Alloy (aUSD₮), a gold-backed stablecoin leveraging their XAU₮ token, which provides digital claims to physical gold reserves. This development aligns with Keiser’s prediction of growing interest in gold-backed digital currencies.

Former VanEck executive and PointsVille founder Gabor Gurbacs compared Tether Gold to the pre-1971 U.S. dollar, referring to the period when American currency maintained gold backing. In a March 19 post on X, Gurbacs highlighted that XAU₮ had appreciated 15.7% year-to-date while broader cryptocurrency markets declined, suggesting organizations should consider it for portfolio hedging.

The push for gold-backed stablecoins contrasts sharply with the approach outlined by U.S. Treasury Secretary Scott Bessent, who indicated the Trump administration would prioritize dollar-pegged stablecoins to protect America’s reserve currency status. These intentions were communicated during the March 7 White House Crypto Summit, with Federal Reserve governor Christopher Waller expressing similar support.

U.S. lawmakers have already introduced multiple stablecoin bills, including the Stable Act of 2025 and the GENIUS stablecoin bill, aiming to establish comprehensive regulatory frameworks for tokenized fiat assets. However, Keiser’s prediction suggests these efforts may face resistance from nations seeking alternatives to U.S. dollar dominance.

The rise of gold-backed stablecoins could represent a return to commodity-backed currencies, albeit in digital form, potentially reshaping international financial dynamics in a way unfavorable to long-standing American monetary influence.

✅ Follow BITNEWSBOT on Telegram, Facebook, LinkedIn, X.com, and Google News for instant updates.

Previous Articles:

- Russian Man Arrested in India for $152B Cryptocurrency Money Laundering

- Crypto Billionaire McCaleb Invests $1B in Space Station to Replace ISS

- Pakistan Proposes Using Runoff Energy to Power Bitcoin Mining Operations

- Trump White House Official: U.S. May Sell Gold Reserves to Buy Bitcoin

- Bitcoin Slumps 17% Amid Tariff Fears, April Resolution Could Spark Rally