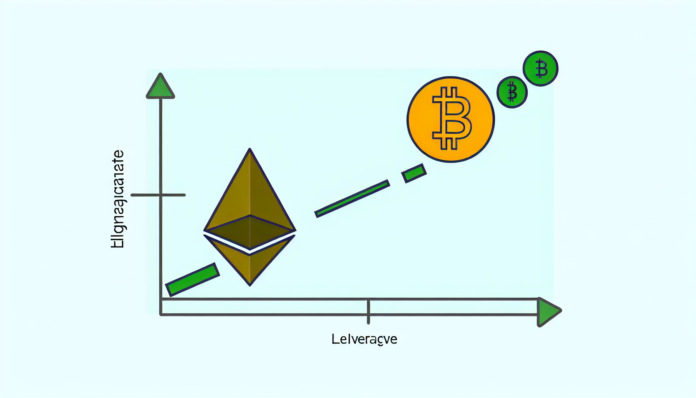

- Ethereum‘s leverage ratio reached 0.57, marking an all-time high compared to 0.37 in early Q4 2024.

- The current leverage level exceeds Bitcoin‘s ratio of 0.269, indicating higher risk appetite for ETH trading.

- Higher leverage suggests increased potential for price volatility in the ETH market.

- The ratio measures the relationship between futures contracts and exchange-held ETH supply.

- Bitcoin’s leverage remains below its October 2022 peak of 0.36.

Ethereum traders are taking increasingly aggressive positions in the derivatives market, with leverage metrics hitting record levels that substantially exceed those seen in Bitcoin trading, according to data from CryptoQuant.

Understanding Leverage Dynamics

The estimated leverage ratio for Ethereum reached 0.57 on Wednesday, representing a 54% increase from its Q4 2024 starting point of 0.37. This metric calculates the relationship between open interest in futures markets and the quantity of ETH available in exchange wallets that offer futures trading.

When traders employ leverage, they can control larger market positions with minimal capital investment. For example, a 10:1 leverage ratio allows control of $10,000 worth of assets with just $1,000 in collateral. This amplification effect works both ways – magnifying potential profits and losses.

Comparative Market Risk

Bitcoin’s current leverage ratio stands at 0.269, its highest point since early 2023 but still well below Ethereum’s levels. This disparity suggests that ETH traders are taking more substantial risks in pursuit of returns.

The heightened leverage in Ethereum markets creates conditions for increased price volatility due to:

- Greater risk of forced liquidations during price swings

- Amplified impact of market movements on trading positions

- Higher concentration of speculative trading activity

Market analysts suggest these metrics indicate Ethereum could experience double the price volatility of Bitcoin in upcoming trading periods, as leveraged positions become more susceptible to market fluctuations.

✅ Follow BITNEWSBOT on Facebook, LinkedIn, X.com, and Google News for instant updates.

Previous Articles:

- AI Protocol Rushes Security Fix After White Hat Spots Critical Smart Contract Flaw

- China-Linked Hackers Hit Treasury, GOP Leaders Demand Answers From Yellen

- BlackRock’s Bitcoin ETF Sees Record $332M Exodus Despite BTC Near $97K

- BitFuFu Inks 80,000-Miner Deal With Bitmain in Global Hashrate Push

- BlackRock’s Bitcoin ETF Sees Record $330M Exit as New Year Trading Resumes