Cryptocurrency trading pairs play a vital role in the cryptocurrency market as they allow traders to buy and sell cryptocurrencies easily. There are various types of trading pairs available on cryptocurrency exchanges, and traders can choose the one that best suits their business needs and preferences.

It is important to note that trading pairs can vary from exchange to exchange, and some pairs may have more liquidity than others. Additionally, the value of a trading pair can be influenced by several factors, that includes market sentiment, supply and demand, and overall market conditions.

Overall, understanding cryptocurrency trading pairs is essential for anyone interested in trading cryptocurrencies, as it provides a fundamental understanding of how cryptocurrencies are priced and traded.

What are Crypto Trading Pairs?

Knowing and understanding the crypto trading pairs are the most significant ones before starting trading, it depends on whether people are new to trading or an engaged strategic trader. Crypto trading pairs are outlined as two cryptocurrencies that can be traded against each other. Each cryptocurrency has a specified crypto value that will continuously change depending upon the crypto market fluctuations.

Even if the market collapses suddenly, a pair trade can make money and gain profit, provided the asset that was bought outperforms the asset that was sold. Pair trading is described as a low-risk trading strategy and it thrives to be a good strategy for active crypto traders.

What is the Purpose of Crypto Trading Pairs?

The main purpose of crypto trading pairs is to facilitate the exchange of one cryptocurrency for another. In the crypto market, there are thousands of different cryptocurrencies, and traders need a way to exchange them for one another.

Crypto trading pairs are used to determine the exchange rate between two cryptocurrencies. For example, if a trader wants to exchange Bitcoin for Ethereum, they would use the BTC/ETH trading pair. The exchange rate between BTC and ETH would be determined by the current market demand for each cryptocurrency.

Trading pairs also make it easier for traders to compare different cryptocurrencies and make informed decisions about which is the best one to buy or sell. By comparing the prices of different cryptocurrencies in relation to one another, traders can identify opportunities for gaining profit and making more strategic trades.

Overall, crypto trading pairs play an essential role in the cryptocurrency market by providing a way for traders to exchange one cryptocurrency for another and offering the price for different cryptocurrencies.

How Do Crypto Trading Pairs Work?

Crypto trading pairs allow you to compare the cost between different cryptocurrencies. This pairing helps to illustrate the relative worth of certain crypto assets.

Exchanges offer numerous pairing options, which gives users a chance to choose the trading pair based on the currencies they already have.

For instance, if you own BTC, then you can trade with any pairing listed on the exchange that includes BTC.

The most versatile crypto trading pairs are mostly BTC and ETH as most of the exchanges offer these pairs.

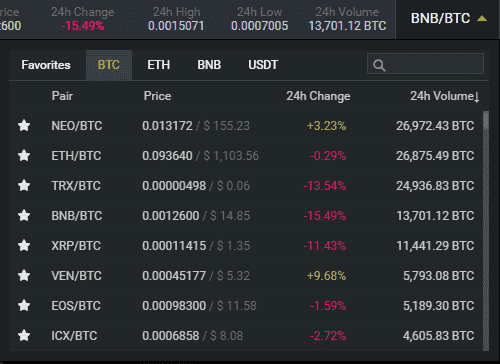

Crypto trading pairs are displayed using the abbreviated forms of the native tokens of crypto networks.

They are represented as a set of 3 letters followed by a backslash such as ETH/BTC where ETH forms the base currency which is called the first cryptocurrency in a crypto trading pair.

The base currency is the base to which other trading currency pairs are compared. The best cryptocurrency pairs to trade are listed below,

BTC/Crypto trading pairs

- BTC/ETH — bitcoin for Ether

- BTC/DOGE — bitcoin for dogecoin

- BTC/LTC — bitcoin for litecoin

- BTC/ADA — bitcoin for cardano

- BTC/XLM — bitcoin for stellar lumens

ETH/Crypto trading pairs

- ETH/BTC — ether for bitcoin

- ETH/BCH — ether for bitcoin cash

- ETH/LINK — ether for chainlink

- ETH/ADA — ether for cardano

- ETH/DOGE — ether for dogecoin

Factors to Consider When Choosing a Crypto Pair for Trading

Cryptocurrency trading can be exciting and potentially a profitable one, but it is important to approach it with a solid understanding of the market. Here are some key points to consider before you start trading using cryptocurrency pairs,

Research the market

Before you start trading, it is important to research the cryptocurrency market and understand how it works. This includes understanding the basics of blockchain technology, the different types of cryptocurrencies, and the factors that can affect the crypto market.

Choose a reputable exchange

Many cryptocurrency exchanges are growing each day, but not all of them gets suited for our business. Choose an exchange that is reputable, secure, and has a good track record of customer support. Look for reviews and recommendations from other traders to find the best exchange for your needs.

Understand the different types of trading pairs

There are two main types of trading pairs in the cryptocurrency market they are, fiat-to-crypto and crypto-to-crypto. Fiat-to-crypto pairs involve the exchange of a fiat currency (such as USD) for a cryptocurrency, while crypto-to-crypto pairs involve the exchange of one cryptocurrency for another. Make sure you understand the differences between these types of trading pairs and choose the right one.

Consider the liquidity of the trading pair

Liquidity refers to how easily a cryptocurrency can be bought or sold on the market. More liquid trading pairs are generally easier to trade and can be bought or sold at a more competitive price. Get to know the liquidity of the trading pair before you start trading.

Develop a trading strategy

To be successful at cryptocurrency trading, you need a solid trading strategy. This should include things like setting entry and exit points, using stop-loss orders to minimize losses, and monitoring market trends and news. Develop a trading plan and stick to it to maximize your success rate.

The Pairs on Your Trusted Exchange

The crypto pairs to trade must be based on the ones provided by the exchange platform. As the security of your funds is important, the choice of trading pairs should be based on the exchange you trust the most, not the exchange you do not trust.

Your Trading Goal

Set your trading goal and what you need to achieve while trading. Do you need a pair that promotes more trading opportunities? You need to choose between high-volatile or lower-volatile trading pairs for good results.

Trends in Cryptocurrency Trading Pairs Explained

There are several trends in cryptocurrency trading pairs that have emerged in recent years they are,

Bitcoin Dominance: Bitcoin has historically been the dominant cryptocurrency, and many exchanges still offer trading pairs with Bitcoin as one of the currencies. This trend is changing, however, as more and more altcoins gain popularity.

Altcoin Trading Pairs: As the number of cryptocurrencies in circulation continues to increase, exchanges are offering more altcoin trading pairs. These pairs allow traders to exchange one altcoin for another, or to trade an altcoin against Bitcoin or another major cryptocurrency.

Stablecoin Trading Pairs: Stablecoins are cryptocurrencies that are staked to the value of a fiat currency, such as the US dollar. Trading pairs with stablecoins have become increasingly popular, as they offer a more stable trading environment.

Decentralized Trading Pairs: Decentralized exchanges (DEXs) have become gradually well-known in recent years, as they allow for peer-to-peer trading without the need for a central authority. These exchanges often offer trading pairs that are not available on centralized exchanges.

Cross-Chain Trading Pairs: Cross-chain trading pairs allow for the exchange of cryptocurrencies across different blockchain networks. For example, a cross-chain trading pair might allow for the exchange of Ethereum for a token that is based on the Binance Smart Chain.

NFT Trading Pairs: Non-fungible tokens (NFTs) are unique digital assets that are stored on a blockchain. Some exchanges are beginning to offer trading pairs with NFTs, allowing for the exchange of these unique assets.

The trends in cryptocurrency trading pairs reflect the growing diversity of the cryptocurrency market, as well as the increasing sophistication of cryptocurrency traders. As the market continues to evolve, it is likely that new trading pairs and trends will continue to emerge.

In conclusion

Cryptocurrency trading pairs are an essential aspect of trading in the crypto market. Before you start trading, it’s important to understand the basics of trading pairs, such as how they work, what their significance is, and how to select the right trading pairs based on your investment goals and trading strategies.

It’s also important to consider the market trends and volatility when selecting trading pairs, as some pairs may have higher risks and potential rewards than others. With the help of a global cryptocurrency exchange development company, you can move forward and build an exchange platform where your platform users can begin their trade by examining the best trading pairs.

By understanding these key concepts, you can make informed decisions when trading in the cryptocurrency market, minimize risks, and maximize profits.

Overall, trading cryptocurrency pairs can be a lucrative investment opportunity for those who take the time to understand the market, the trading pairs, and the risks and rewards associated with them.

READ NEXT

Previous Articles:

- The Big Problem With Digital Banks – and How To Overcome It.

- Bit Digital Expands Bitcoin Mining Operations to Iceland Amidst Taxation Concerns in the US

- How to Significantly Cut Blockchain Development Timetables for a Quicker Time-to-Market and Lower Costs

- Tether Bolsters Reserves: Announces Major Bitcoin Investment to Support USDT Stablecoin

- Ripple Makes Strategic Move: Acquires Swiss Startup Metaco for $250 Million Amidst US Regulatory Challenges