Maybe it is because summer is the season when we generally relax the most, the lazy mood due to the heat, the absence of important macroeconomic news, the fact that neither a rate hike nor a rate cut by the Fed is foreseen in the coming months, the waiting for the decision on the approval or not of BlackRock’s Bitcoin ETF. Or any other overt or covert reason being responsible.

The fact is, however, that the price of Bitcoin is stuck near $30,200, dragging down the entire crypto market. Because as we know all too well, Bitcoin is the flagship. Without its own significant movement, the market isn’t going anywhere on its own.

What does that mean?

That at least traders, if not everyone else interested in cryptocurrencies, should be on the lookout. Most likely, once the current period of accumulation is over, the price will surge. Up or down? We cannot know, but if the scenario of a sharp move does apply, then it is relatively easy to take advantage of it.

This is the largest accumulation of Bitcoin ever in a small price range. The oblique move hasn’t just been happening for a month. Also from March to May 2023, as well as from May to June 2022, 30,200 acted as a magnet.

Once again from Glassnode we caught another remarkable statistic. The percentage of coins in the hands of long-term investors is at its highest point ever.

Of the total bitcoin in circulation, 14.52 million coins, or 75%, are held by entities – from individuals and businesses to institutions – that are not willing to part with them. At least not at these price levels.

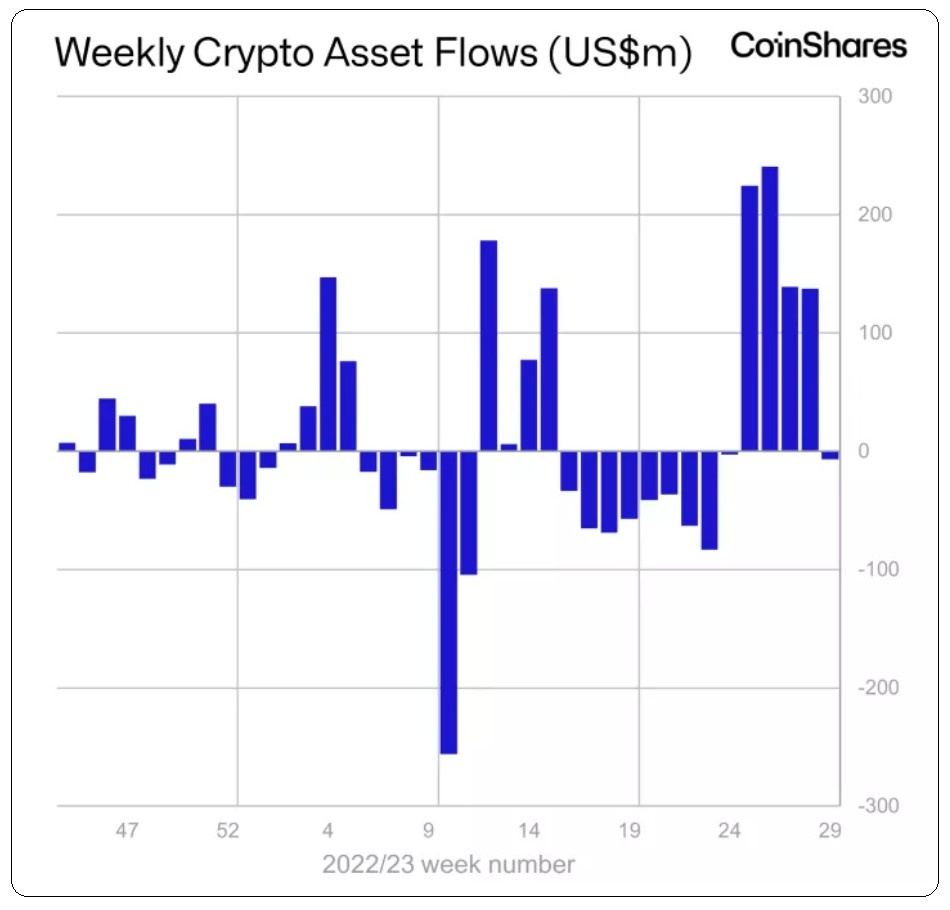

But the indications are not only optimistic. According to another research firm, CoinShares, after four consecutive weeks of positive inflows, investors have started to pull money away from cryptocurrency-related investment products.

Specifically, there was an outflow of $6.5 million, after inflows totaling $742 million. When we refer to investment products, we are referring to Grayscale shares and other funds that primarily target institutional investors.

However, the head of the survey clarifies, there may have been a cash withdrawal in Bitcoin-related securities, in Ethereum placements continued.

READ NEXT

- Worldcoin: Where Crypto Meets the Iris Scan – Real IDs for the Real Deal!

- Solana’s Rocky Ride: Overcoming Regulatory Waves, Soaring Towards Growth

- PrivadoVPN Review – Don’t Buy Before You Read This

- Are Cryptocurrency Securities?

- Democratic Candidate Robert Kennedy Pledges Bold Economic Plan Backed by Gold and Bitcoin

Previous Articles:

- Worldcoin: Where Crypto Meets the Iris Scan – Real IDs for the Real Deal!

- Solana’s Rocky Ride: Overcoming Regulatory Waves, Soaring Towards Growth

- PrivadoVPN Review – Don’t Buy Before You Read This

- Are Cryptocurrency Securities?

- Democratic Candidate Robert Kennedy Pledges Bold Economic Plan Backed by Gold and Bitcoin