- Bitcoin Price reached a new all-time high near $80,000, marking a 15% increase in one week

- PlanB’s stock-to-flow model predicts Bitcoin could reach $500,000, with a range between $250,000 and $1 million

- The model’s creator labels the early 2024 ETF-driven rally to $73,737 as a ‘fake-out’

- Trump’s presidential victory appears to have sparked renewed investor interest in cryptocurrency

- Tether minted $2 billion USDT in 2 days, with $2.54 billion flowing to exchanges since November 6

Bitcoin Surges Past Previous Records as Stock-to-Flow Model Points to $500K

Bitcoin’s remarkable price action continues as the cryptocurrency reaches new heights near $80,000, representing a 15% increase within a single week.

This surge has reignited interest in Price Prediction models, particularly the well-known stock-to-flow analysis by analyst PlanB.

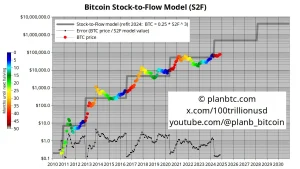

The stock-to-flow model, which compares Bitcoin’s existing supply to its production rate, suggests a potential price target of $500,000 per Bitcoin.

This projection includes a range between $250,000 and $1 million, according to PlanB’s recent social media announcement.

Understanding the Stock-to-Flow Model

The stock-to-flow model draws parallels between Bitcoin and scarce commodities like Gold and silver. It calculates value based on two primary factors:

– The existing supply (stock)

– Annual production rate (flow)

The model gains relevance due to Bitcoin’s halving events, which reduce new coin production by 50% every four years, theoretically increasing scarcity and value.

However, the model’s track record shows mixed results. Previous predictions, including targets of $100,000 and $135,000 by late 2021, did not materialize as projected.

Trump’s Victory and Market Response

The cryptocurrency market has shown strong reaction to Donald Trump‘s presidential victory. This political development appears to have triggered significant capital movement into the crypto space, evidenced by substantial ETF inflows and increased stablecoin activity.

Data from blockchain analytics reveals that Tether has minted $2 billion USDT within just 48 hours. More notably, $2.54 billion USDT has moved from Tether to various cryptocurrency exchanges since November 6, indicating substantial buying pressure may be building.

Market Indicators and Investment Flows

The current rally differs from the January 2024 surge to $73,737, which PlanB characterized as a “fake-out” following the launch of U.S.-based Bitcoin ETFs. The present market movement shows signs of more sustained momentum, supported by:

– Increased institutional investment through ETFs

– Large-scale stablecoin minting

– Significant transfer of funds to exchanges

– Growing market confidence following political clarity

These factors suggest stronger market fundamentals compared to previous rallies, potentially supporting PlanB’s ambitious price projections.

Technical Analysis and Market Outlook

The stock-to-flow model’s latest iteration maintains its original parameters while incorporating five years of new data. This update continues to support the projection of Bitcoin reaching $500,000, following a pattern that could eventually lead to even higher valuations.

The substantial movement of stablecoins to exchanges indicates that market participants may be positioning themselves for further price appreciation, creating potential for additional upward momentum in Bitcoin’s value.

Previous Articles:

- DOGE Hits $0.23 as Trump Victory Sparks Rally, Analysts Eye $3.9 Target

- Cardano’s ADA Surges 30% as Founder Plans Role in Trump Administration

- Crypto Industry Fundraising Surges 96% in October, Reaching $1.76 Billion

- Block Inc. Shifts Focus to Bitcoin Mining Tools as Trump Promises Crypto Support

- US Election Impact: BNB, Shiba Inu, and IntelMarkets Set Ambitious Price Targets