The price of bitcoin would be in the seventh bull cycle in its history, says hedge fund Pantera Capital, which specializes in cryptocurrencies.

“Digital assets have now hit their all-time lows and we are in the next bull cycle,” the firm’s founder and CEO, Dan Morehead, said in a letter to the fund’s clients.

Morehead stated that Pantera has been investing in bitcoin over the past 10 years, which have seen six bull cycles and six bear cycles, prior to the current cycle. “The fund has invested in 12 of the 13 bitcoin cycles on record,” Morehead states in the report.

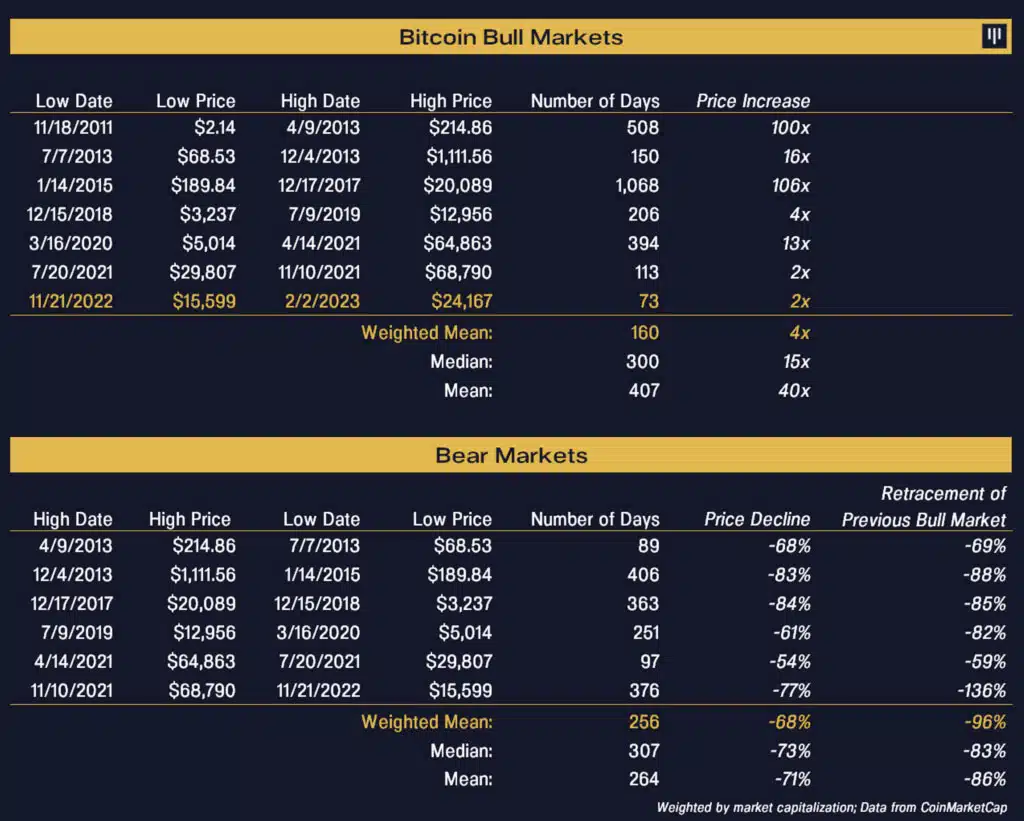

The tables below note the aforementioned cycles. In the case of the bull cycles, there are two of them in which the price increased by factors greater than 100, although the rest of the increases show growth factors between 2x and 4x.

Pantera speaks of an average increase of 40x, although it performs a weighting of the same, taking into account that the large increases up to 2015 corresponded to relatively low prices. The weighted average of bitcoin’s annual increases is approximately 4x.

As for bitcoin price declines, the steepest was recorded between December 2017 and December 2018, which was 84%.

The latest bitcoin bear cycle occurred between the all-time price high of USD 68,790 to the low recorded in November 2021 of USD 15,599. The price pullback was 77%, the third highest ever recorded for bitcoin price.

BTC bullish despite correction

In the chart below, Pantera shows a graph in which bullish cycles are marked with gold bars and bearish cycles in black spaces. It can be seen that the length of bullish cycles tends to be shorter in more recent cycles.

The last bull cycle, in 2021, is the shortest and shows the lowest price increase. It lasted 113 days and in that cycle there was a doubling of the price. In the current cycle, the percentage increase is 55%, taking into account the maximum reached so far of UD 24,167, recorded last February 2.

The dotted line on the chart marks bitcoin’s long-term trend. On average, the report states, the price of bitcoin has grown 2.3 times per year.

Despite the downtrend since November 2021, bitcoin shows 31% appreciation from the beginning of the year. Meanwhile, some metrics associated with the rate of profit on the purchase and sale of BTC would be signaling a key movement in the price of bitcoin.

Read Next

National Flags Take Flight on Bitcoin Blockchain with Ordinals Protocol

Blockstream CEO Predicts $10 Million Bitcoin Price by 2032

New Bitcoin Investors Flood the Network: 620K Addresses Join with 0.1 BTC or Less

Pantera Capital CEO: $40 Trillion Cryptocurrency Market Cap Is ‘Definitely Possible’

Pantera Capital Already Raises Over $70 Million for Its Third Crypto Fund

Previous Articles:

- SEC Crackdown on Staking Sparks Controversy

- National Flags Take Flight on Bitcoin Blockchain with Ordinals Protocol

- 6 Ways Cryptocurrency Can Replace Money

- How Do Cryptocurrency Scams Work?

- Blockstream CEO Predicts $10 Million Bitcoin Price by 2032