The price of Bitcoin was on a launch trajectory on Wednesday, dragging the entire cryptocurrency market upwards. More specifically, it reached a breath away from $25,000, where it is currently taking a break… to rest.

And how could it not need to take a breather, when in 24 hours it has climbed 13%, already posting weekly gains of 16.5%. It hasn’t been at this price since August 15!

In the 4-hour chart below we see that for a month the price was stuck in the narrow range of $16,500 to $17,000.

However, in the first ten days of the year it managed to escape the parallelogram accumulation formation (blue parallel lines) and began a frantic run towards $25,000, having already reached a 46% rise since the beginning of the year.

Obstacles are to be overcome

The $25,000 level is a particularly critical point, according to Jamie Thomson, founder and CEO of Vulcan Forged, one of the world’s leading platforms in blockchain gaming and Metaverse.

As he said on Tuesday, at the event organized by the Institute of Digital Finance, if the price stays above $25,500-26,000, we can talk about the beginning of a bull run!

Bitcoin is once again proving to be a seven-souled beast. The spectacular rise came at the height of the controversy and despite the crisis of confidence from repeated bankruptcies and scandals, such as the FTX group.

As the psychological impact passed and seeing that it did not drag other companies or funds into the abyss, people began to realize that Bitcoin is one thing and FTX, Genesis, BlockFi, Celsius are another.

Just like the dollar is one thing and Lehman Brothers is another. Enron is one thing and natural gas is another. The lesson may have been hard, but it was also simple.

The other hurdle that cryptos seem to be overcoming is the hunt that the US Securities and Exchange Commission (SEC) has embarked on.

The SEC is not only focusing on what would make sense, namely overseeing the smooth operation of exchanges and the dollar coverage that stablecoins are required to have, but has even gone so far as to put staking in its sights!

Already the Kraken exchange has reached a settlement with the SEC, paying a fine and discontinuing its staking services for its US customers.

Here, of course, we should note that Gary Gensler, head of the SEC, has managed to strengthen Bitcoin with his statements. By claiming indirectly – sometimes directly – that all other cryptocurrencies belong to the category of securities, so they must comply with the current legislation, he has made many people alarmed and convert their altcoins into Bitcoin!

That this is the case is reinforced by the fact that on Wednesday the percentage rise was greater in Bitcoin than in the other major cryptocurrencies.

NFTs on the Bitcoin network

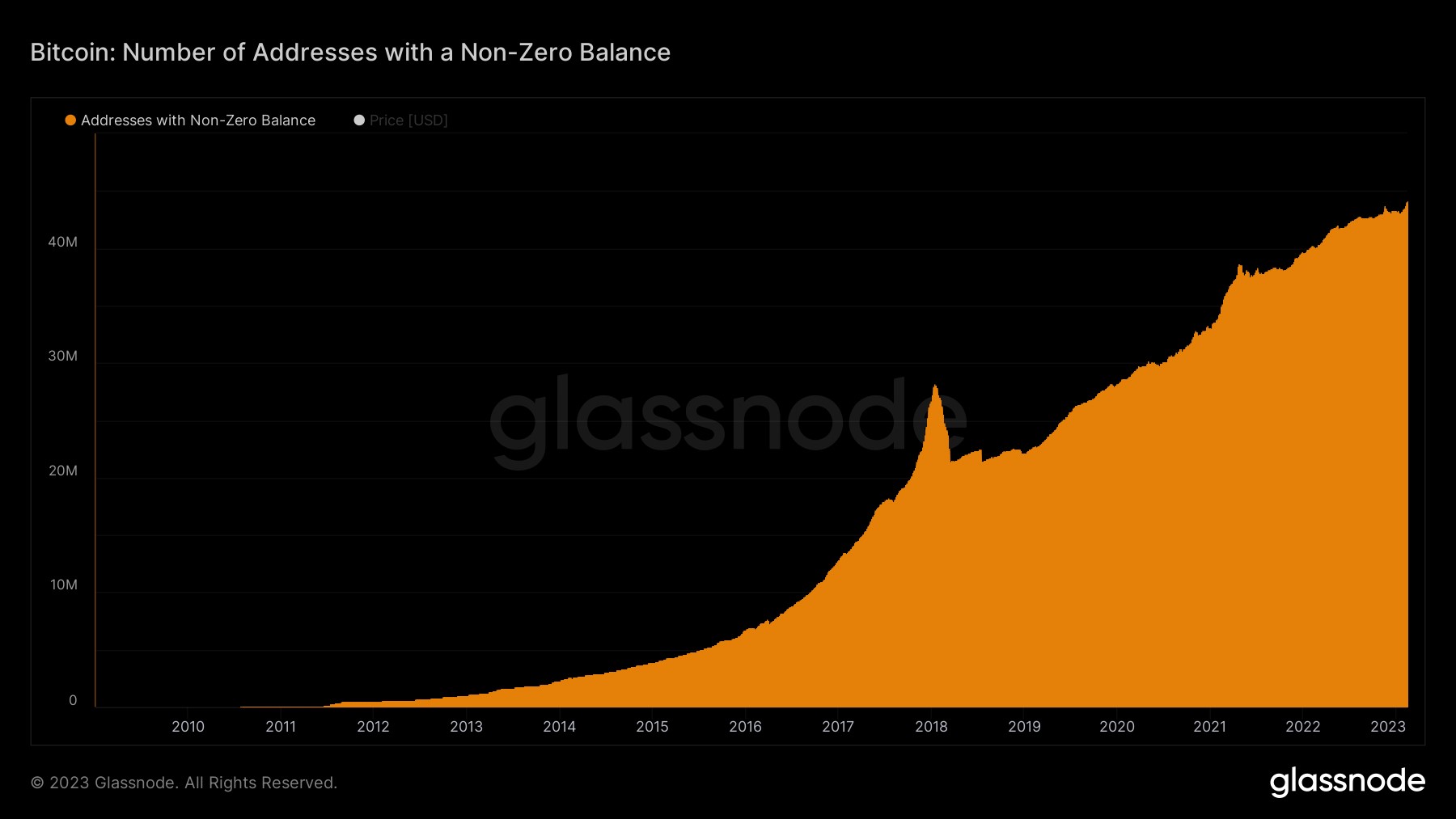

One important reason why new addresses have been added is that NFTs can now exist on the Bitcoin network, thanks to the Ordinal protocol. What is Ordinal?

It enables you to send a Satoshi (100 million is one Bitcoin) accompanied by additional data! This data can be in the form of text, image, video, pdf, etc. These accompanying data are called inscriptions.

The number of inscriptions has exceeded 100,000 in a very short time, giving a new dimension to the possibilities of Bitcoin. One of them is that NFTs can be made on the Bitcoin network! NFTs can be created (minted) by anyone running a node. That is, they give the incentive to obtain nodes, which among other things, increase the security of the network!

The NFTs found on the Satoshi are not based on smart contracts but are registered directly on the blockchain. The new feature was thanks to the recent Taproot upgrade, which started to be activated at the end of 2021.

Already many of the NFTs that were on other chains are planning to “transcribe” to the Bitcoin network, as they want to enjoy its advantages such as security, simplicity, durability and the possibility of unhindered transfer and storage.

In simple terms, the Ordinal protocol enables a serial number to be put into each Satoshi, which can be identified in transactions.

According to research firm Glassnode, this is a historic moment for the Bitcoin network, as now Bitcoin transfers are not just about transferring monetary value.

Read Next

- Bitcoin miners earned nearly USD 600,000 USD in commissions on Ordinals NFTs

- Federal Reserve Bank of New York Identifies Bitcoin as a Savings Instrument Similar to Gold

- NYDFS Shuts Down Binance USD Issuance, Questions Unresolved Issues

- Bitcoin’s Seventh Bull Cycle: A New Era of Growth Ahead

- SEC Crackdown on Staking Sparks Controversy

Previous Articles:

- Norway Seizes $5.8 Million in Cryptocurrency Stolen by North Korean Hackers

- The Sandbox Signs MOU with Saudi Arabia to Develop Metaverse Activities

- Dovu (DOV) aims to solve a major environmental problem while offering investors an impressive growth of 233%

- SEC Files Multi-Billion Dollar Crypto Fraud Lawsuit Against Terra Founder Do Kwon; Alleges Deceptive Marketing Tactics

- Bitcoin miners earned nearly USD 600,000 USD in commissions on Ordinals NFTs