- Bitcoin market shows contrasting dynamics between surface-level selling pressure and deeper buy orders.

- Current quote-level trends indicate increased selling activity from market makers.

- Order book depth analysis reveals strong buying interest at 2-5% below market price.

- Bitcoin Price declined from $102,000 to $94,000 amid U.S. inflation concerns.

- Market participants await U.S. nonfarm payrolls data for next directional move.

Surface Sellers Mask Bitcoin’s Hidden Strength

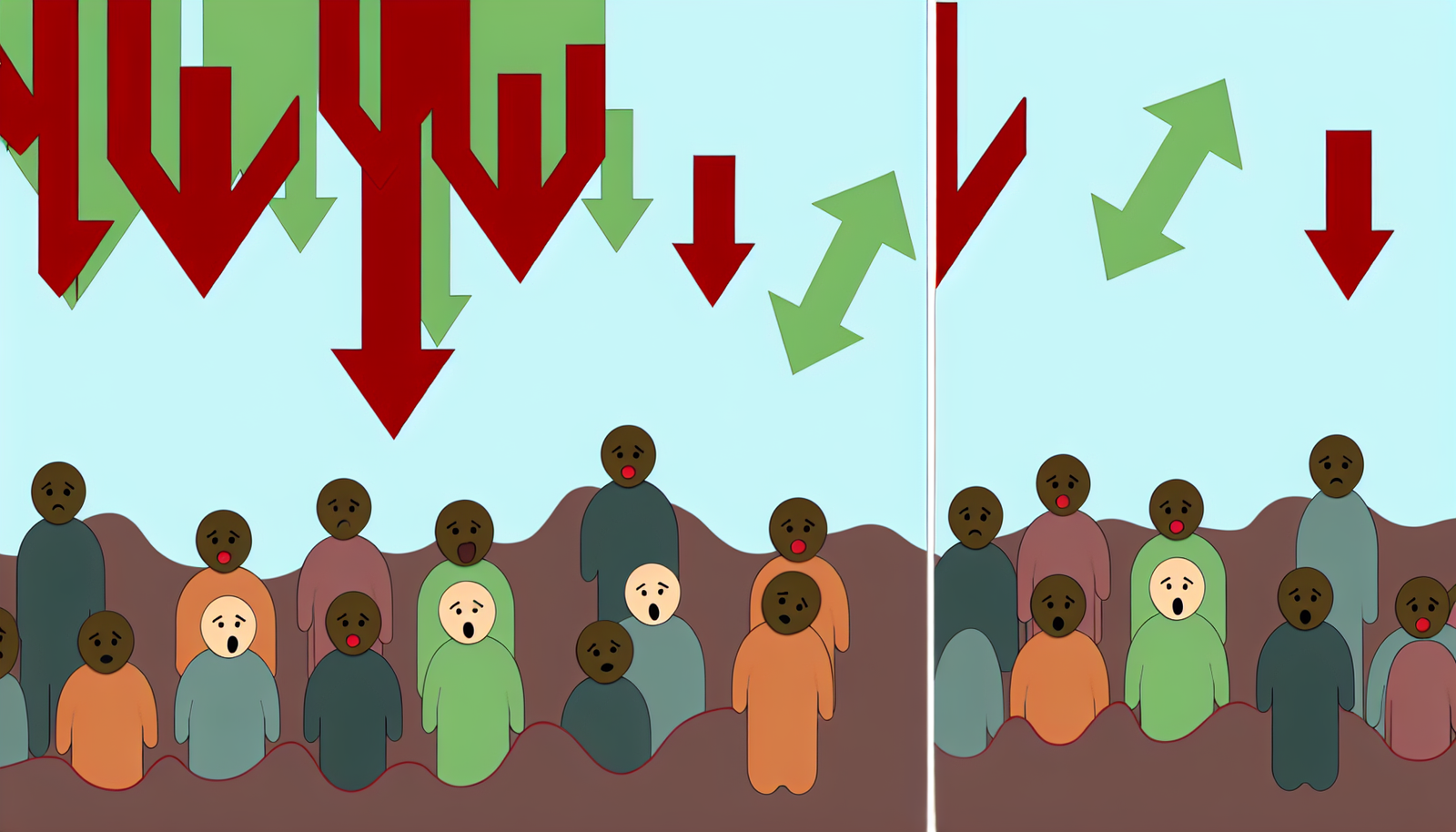

Recent data from Hyblock Capital reveals a complex market structure in Bitcoin trading, where visible selling pressure conceals substantial buying interest at deeper price levels. The cryptocurrency, trading near $94,000, displays divergent patterns between immediate market activity and underlying order books.

Market Maker Dynamics

Analysis of major spot and perpetual futures exchanges indicates a shift in quote-level trends from upward to downward momentum. This change reflects increased selling activity at current market prices, primarily driven by market makers adjusting their positions. The order book depth between quote level and 1% echoes this selling bias.

Hidden Buy Orders

Contrary to surface appearances, the order book analysis from 2% to 5% below current prices shows an accumulation of buy orders. This pattern suggests larger investors are positioning themselves to acquire Bitcoin at lower prices, potentially creating price support levels. The phenomenon mirrors similar market behavior observed during previous price corrections.

Economic Context

The recent price decline from $102,000 to $94,000 occurred against a backdrop of heightened U.S. inflation concerns. Market volatility reached a peak when prices briefly touched $92,500. Traders are now focused on upcoming U.S. nonfarm payrolls data, which historically has influenced cryptocurrency market movements through its impact on broader financial markets.

The order book structure, showing increased demand between 1-2% and 2-5% levels, indicates institutional investors may be preparing for potential price rebounds, despite current market uncertainty.

✅ Follow BITNEWSBOT on Facebook, LinkedIn, X.com, and Google News for instant updates.

Consider a small donation to support our journalism

Previous Articles:

- Senate Banking Committee Plans First-Ever Crypto Subcommittee as Industry Oversight Expands

- Former Bank of China Executive Criticizes Trump’s Bitcoin Reserve Strategy

- Bitcoin Slides Below $92K as Markets Brace for December Jobs Report

- Global Student Network Launches Bitcoin Education Initiative Spanning 25 Countries

- Crypto Platform Under Fire for ‘Disgusting’ Wildfire Betting Markets