Bitcoin Price Headed Way Down, But Will Hit $5K Eventually

The bitcoin price failed in its attempt to rise above $4,000 USD. That means we have a long way down before the markets can rally upwards.

Also read: Crypto Rally Puts Bitcoin Price Back Above $4,000 — 2019’s Highest Prices (So Far)

Subscribe to the YouTube channel for great videos featuring industry insiders & experts

Bitcoin Price Technical Analysis

Long-Term Analysis

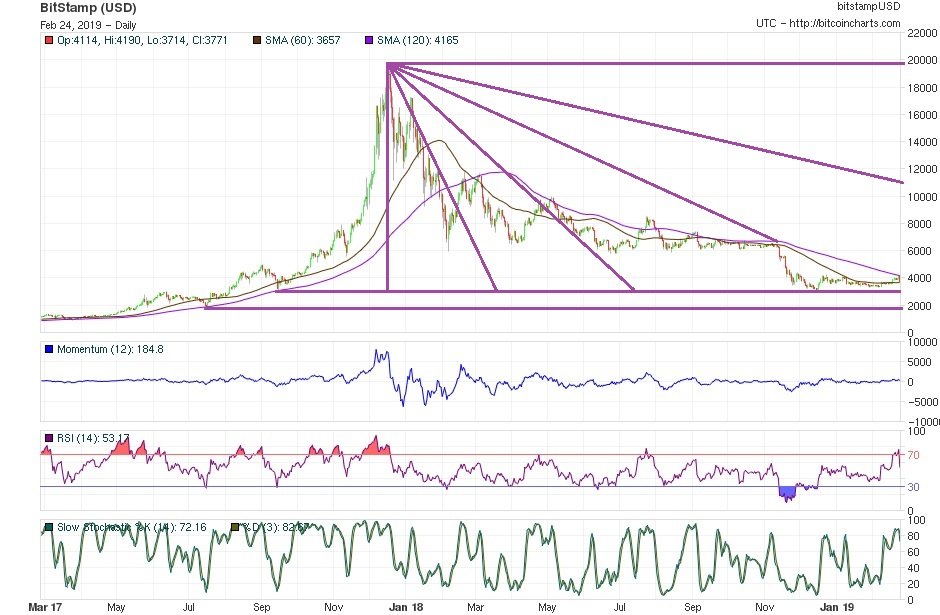

Using the last all-time high bitcoin price as a starting point, Gann Angles Theory reflects a possible downward correction, sending the price back into the lateral market that has dominated the action since November 2018.

Combining that criteria with Mass Psychology Analysis, the current Capitulation phase could drive the action even lower to $2,500, where a V bottom bounce can be expected. After that bounce, the bearish trend will most likely end, starting a new, long-term bullish cycle with its first main objective estimated to be near $5,000.

Mid-Term Analysis

A strong distribution area can be analyzed over $4,000, while the first reliable support remains at $3,500. Fibonacci´s 23% retracement level sets a limit to the rise attempt, exhausting all mathematical indicators and leaving the bitcoin price without bullish signs.

Furthermore, with the current $3,000 support held up purely by Round Numbers Theory and wishful thinking from holders, there is no concrete support besides the one established below $3,000 in 2017 — before the bubble. Thus, a deep swing can be expected with the possibility of a strong V bottom bounce near $2,500.

Short-Term Analysis

Japanese Candlesticks and support/resistance analysis show demand has withdrawn the Soldiers from the battlefield, weakening stability in the lateral market. Meanwhile, Offer´s Crows took hold at the $4,000 level where a distribution zone blocks every bullish advance.

The next stage can be analyzed as an extended distribution area between $4,200 and $3,700. The adverse scenario laid out above would drive the action to lower levels, promoting a bearish swing to $2,500 before reversing upwards to $5,000.

What do you think will happen to the bitcoin price? Share your predictions in the comments section.

If you find Ramiro’s analyses interesting or helpful, you can find out more about how he comes to his conclusions by checking out his primer book, the Manual de Análisis Técnico Aplicado a los Mercados Bursátiles. The text covers the whole range of technical analysis concepts, from introductory to advanced and everything in between. To order, send an email to [email protected]

Image via Pixabay

This technical analysis is meant for informational purposes only. is not responsible for any gains or losses incurred while trading bitcoin.

Previous Articles:

- Long-Term Bitcoin Price Indicator Turns Bearish, Suggesting Bottom May Be In

- Venezuelan Explains How Bitcoin Saves His Family

- FBI Seeking Potential Victims of BitConnect to Assist Investigation

- Coinbase Wallet Uses the Cloud to Back Up Crypto Keys

- Token Development Using the Bitcoin Cash Network Kicks Into High Gear