- Bitcoin experienced its worst first quarter in a decade, falling 11.7% amid uncertainty about the new administration’s economic policies.

- Historical data shows mixed outcomes after poor Q1 performances – in some years Bitcoin recovered strongly, while in others it continued to decline.

- Recent macroeconomic tensions, including Trump’s tariff announcements that caused major market selloffs, create an unclear outlook for Bitcoin.

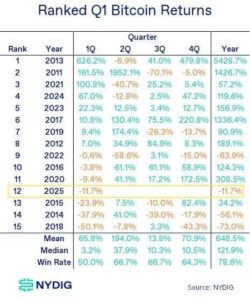

Bitcoin closed out its worst first quarter in a decade, dropping 11.7% as markets struggled to interpret the economic direction of the new administration. This performance ranked 12th among the past 15 first quarters, according to research data from NYDIG.

The significant Q1 decline has raised questions among crypto observers about whether the current market cycle is nearing its end. NYDIG’s research highlights that Bitcoin hasn’t performed this poorly to start a year since 2015, which followed the 2013 peak and the collapse of Mt. Gox.

Historical precedent shows mixed outcomes after weak first quarters. In 2015, prices eventually recovered modestly through the remainder of the year before surging in 2016. Similarly, in Q1 2020, Bitcoin saw a 9.4% drawdown during the COVID-19 market panic but rebounded dramatically to finish the year up over 300%.

The Historical Pattern Is Mixed

Not all recovery stories end positively, however. In years like 2014, 2018, and 2022, negative Q1 returns preceded sharp year-end declines, coinciding with the conclusion of previous bull market cycles.

The current landscape presents conflicting signals. Bitcoin prices initially surged after Donald Trump won the U.S. election in November, bolstered by his pro-crypto campaign stance. The cryptocurrency sector has since gained greater regulatory clarity as the U.S. Securities and Exchange Commission (SEC) backed away from several lawsuits against crypto firms.

Macroeconomic Headwinds Emerge

Despite these positive developments, broader economic concerns have surfaced. Trump recently unveiled reciprocal tariffs targeting nearly every country globally, triggering a massive $5.4 trillion wipeout in U.S. equities markets over just two days. This selloff pushed the S&P 500 to its lowest level in 11 months and sent the Nasdaq 100 into bear market territory.

While Bitcoin has outperformed traditional markets so far, its reaction following Monday’s opening bell remained uncertain. NYDIG’s data indicates that poor first-quarter performance doesn’t necessarily doom Bitcoin for the year, as the asset has rebounded in half of the years when it started in the red.

Recent economic developments have led analysts to raise recession odds, potentially testing Bitcoin’s proposed role as a “U.S. isolation hedge.”

✅ Follow BITNEWSBOT on Telegram, Facebook, LinkedIn, X.com, and Google News for instant updates.

Previous Articles:

- Web3 Gaming Struggles to Capture Mainstream Audience Amid Crisis

- Trump’s Tariff War Sparks Bitcoin Price Panic Amid Looming Crypto Crisis

- Credit Spreads Hit Highs as Bitcoin Faces Potential Market Stress Test

- Hyperliquid $6.2M Exploit Exposes Vulnerabilities as DEXs Challenge CEXs

- Bitcoin Defies Market Turmoil, Holds Above $80k Amid Global Sell-Off