Investing in cryptocurrencies has become a popular way for people to diversify their investment portfolio and make potential profits.

However, with so many cryptocurrencies available out there, it can be difficult to determine which ones are worth investing in and which ones are not.

In this article, I will answer the question Which are the best crypto to invest in based on my experience in the field and the usability of each one.

☝️ IMPORTANT: If you are looking for the next 1000X meme-coin I am going to disappoint you. You won’t find anything like that in this article.

Also, I want to clarify that the cryptocurrencies you will see below will not make you rich overnight. DO NOT get “seduced” by gurus or the next crazy meme coin that will give a 1000X return in 1 month. This is like betting. You will win once and you will lose many times.

Investing in cryptocurrencies has risks and you should only invest what you can afford to lose.

Furthermore, I must tell you that I am not a financial advisor and will not be held responsible for any losses that may result from your actions.

Best Crypto To Invest In

1. Bitcoin (BTC)

The first cryptocurrency on this list is Bitcoin. Yes, despite what everyone says, it is indeed the best and safest investment in my opinion.

It is widely recognized as the “gold” of cryptocurrencies and has a long history as a reliable store of value – just like gold.

I believe that Bitcoin will continue to be a key asset for people who want to protect their wealth in the new global digital economy we are moving towards.

Also, its limited circulation (only 21 million Bitcoin) and increased demand (especially now that the global economy is going from bad to worse) makes me believe that its value will skyrocket in the coming years and surpass its all-time-high of 70,000 USD.

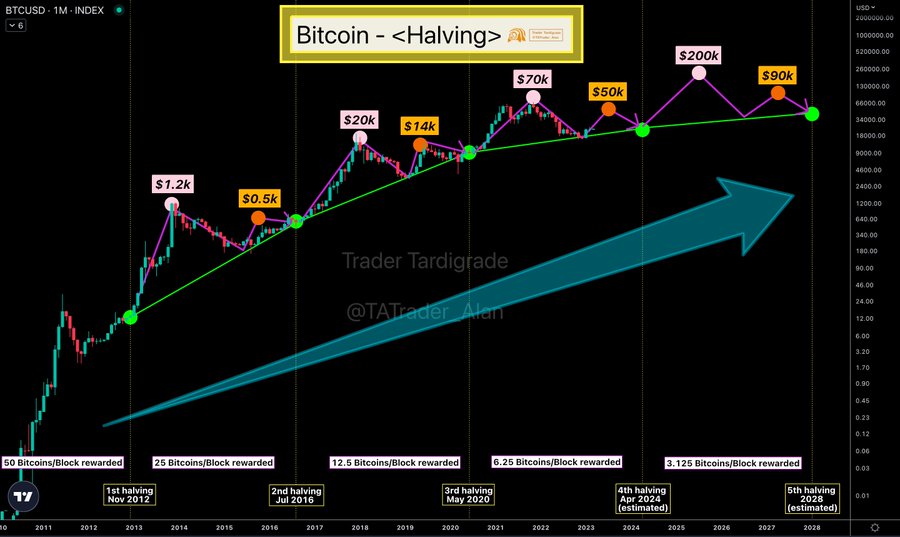

Not to forget also the upcoming halving that will take place in 2024 which reinforces this view. Just for information, the price of Bitcoin goes up after each halving.

2. Ethereum (ETH)

Ethereum is the second most popular cryptocurrency and is often referred to as the software on which the new global economy will be built.

Ethereum has now become the “platform” that allows developers to create decentralized applications (DApps).

In the simplest terms, it is a platform that provides the code and tools to build programs.

Ethereum’s smart contracts functionality allows developers to create automated contracts that execute when certain conditions are met.

This feature makes Ethereum a flexible platform for building a wide range of DApps, including decentralized financial (DeFi) and non-fungible tokens (NFTs).

My view is that Ethereum is now too big to fail. I also believe that no matter how many new blockchains and “ethereum-killers” come out, they will never be able to catch up.

Ethereum’s path is only upwards and its price is still relatively low.

3. Hedera Hashgraph (HBAR)

Hedera Hashgraph is a third-generation blockchain that aims to improve on the limitations of previous blockchain technologies.

Unlike traditional blockchains that rely on a proof-of-work (PoW) or proof-of-stake (PoS) consensus mechanism, Hedera Hashgraph uses a consensus algorithm called Hashgraph.

This algorithm enables faster transaction times, increased scalability and better security.

Personally, I have been investing in Hedera for many years because:

- If you study its technology a bit you will see that it is unique. Watch this video. 👇

- The speed and number of transactions it can run simultaneously far surpasses that of Ethereum and even Visa.

- The transaction fees are insignificant. They are around $0.001 per transaction.

- It is constantly on the rise in both users and transactions through its technology.

- Hedera Hashgraph is run by well-known organizations around the world such as DELL, Google, IBM, LG, UBISOFT and many others.

Considering all of the above, and at such a low price that you can get Hedera at the moment, I feel that it is a sin not to have it in your portfolio. I believe Hedera will explode in the next bull-run (which is imminent).

4. Polygon (MATIC)

Polygon is a ” layer 2 scaling solution” for Ethereum. It aims to solve Ethereum’s scaling problems, allowing for faster and cheaper transactions.

In essence, it is built on top of Ethereum and allows developers to build their programs with the tools and security that Ethereum offers but with faster and cheaper transactions.

Polygon has gained significant attention in recent months and has partnered with major players such as Warner Group, Facebook, Disney and Starbucks.

These partnerships prove the potential of the platform. I’m sure you understand that these organizations do NOT make their choices by accident.

And if all these organizations build products with Polygon, imagine what will happen in terms of the price of token once the transactions start flowing in.

5. Gala Games (GALA)

Gala Games is a game studio that has created several functional games that use blockchain technology to store the data and NFT generated within their games.

Although there are hundreds of gaming startups promising to make the next gaming-hit, Gala Games is the only one that has managed to have games already played by hundreds of thousands of people around the world.

Some of Gala Games’ games that have received significant recognition are TownStar and Superior.

The Gala doesn’t stop here though. In the pipeline are Gala Films with several productions in the pipeline and Gala Music which hopes to build a decentralized Spotify.

This whole ecosystem is powered by the GALA Token. The company still has a long way to go. I’m just confident that the price of the token will skyrocket as newer and newer partnerships are announced and the demand for the Gala Token increases.

6. Cosmos (ATOM)

Cosmos (ATOM) is a platform that aims to connect all blockchains together.

The interoperability offered by the platform allows different blockchains to communicate with each other, enabling better collaboration and seamless transactions between networks.

For example, if you want to send your Ethereum from a wallet that only supports Ethereum Network to a wallet that only supports Tron Network you can’t. If you do, your Eth will be lost.

But there are wallets that allow you to send tokens from any blockchain and receive them in your wallet. 90% of wallets or Dapps that have this capability use the technology offered by COSMOS.

So, the COSMOS network – as I understand it at least – has become the go-to-place if you want to add interoperability to your blockchain or Dapp. This fact encourages me to increase my investment in ATOM and recommend it in my articles.

7. Theta Network (THETA)

Theta Network is a blockchain with a focus on video, media and entertainment. The platform aims to improve the quality of video streaming and reduce costs by using a decentralized network of nodes to distribute video content.

Theta Network has already entered into partnerships with several high-profile companies in the media and entertainment industry, including the World Poker Tour, Samsung, Sony and MGM Studios.

Its innovative technology and the platform’s partnerships with entertainment industry giants position it well for future growth in the media and entertainment industry.

Also, with a value of less than one euro per THETA token, I consider it to be one of the “little gems” worth investing in.

8. Monero (XMR)

You’ve definitely heard of Monero before. It has been around since the time of Bitcoin. The difference between this cryptocurrency and Bitcoin and any other cryptocurrency currently in existence is that transactions made with Monero cannot be linked to your a person’s identity in any way.

It’s untraceable.

Now you will may ask “and why should I invest in this cryptocurrency”?

The reason is simple – although it may sound frivolous.

Just as I believe that Bitcoin will be the gold standard in the new global economy they are pushing on us towards, thus Monero will be the medium of exchange for those who want to make untraceable transactions.

Your next question may be: ” and who are the people who want to make undetectable transactions”?

The mafia, the banks (yes, the banks), the rich, companies that want to hide profits from governments, politicians who want to hide their backgrounds, etc.

To this day, they would have to set up offshore companies, write off assets right and left (all those Panama papers you hear about) to hide their wealth.

Monero will be their medium of exchange to hide their transactions in the world of cryptocurrencies and blockchain technology.

Let’s not forget that blockchain technology stores every transaction forever. You won’t be able to hide anything. All transactions will be seen and stored on a blockchain.

Those who want to bring us the new global economy (meanwhile I realize that I may sound like a conspiracy theorist – but I don’t care anyway), also want to have a way to transact without being able to link a transaction to the identity of the person who makes it.

Monero has been around for over a decade they haven’t stopped it. I wonder why?

Anyway, the value of Monero – like the rest of the cryptocurrencies on this list I believe will skyrocket in the near future.

Tips for investing in cryptocurrencies

Investing in cryptocurrencies can be exciting, but it’s important to do it wisely. Here are some tips that can help you make the right investment moves:

Bottom Line

These are my top picks for the best cryptocurrencies to invest in based on their usability and growth potential – and what I think, being just a blogger.

However, investing in cryptocurrencies has many risks and it’s important to do your research before buying anything and only invest what you can afford to lose.

Furthermore, I want to reiterate that I am not a financial advisor and you should consult a professional before making any investment decision.

READ ALSO

Previous Articles:

- Bitcoin Could Reach New All-Time High by June 2024, Predicts Renowned Analyst

- Bitcoin Network Fees Drop Over 70% as Congestion Eases, Bringing Relief to Users

- PayPal Discloses Holding Nearly $1 Billion in Cryptocurrencies, Bolstering Confidence in Digital Assets

- Bitcoin’s Recent Dip Sparks Long-Term Investor Accumulation: A Bullish Sign Amidst Concerns of Divergence with Tech Stocks

- Aptos Labs Teams Up with Mastercard to Enhance Trust in Blockchain Transaction