TL;DR – Cryptocurrencies are not typically considered securities, as they are decentralized digital assets that operate independently of any central authority or government. However, it is important to note that certain types of cryptocurrencies, known as security tokens, may be classified as securities if they meet specific criteria outlined by regulatory authorities. Security tokens represent ownership in a company or entity and are subject to securities regulations.

Table of Contents

Are Cryptocurrency Securities?

You may be wondering, are cryptocurrency securities? It’s a question that has sparked debate and legal battles in recent years.

The Securities and Exchange Commission (SEC) has taken enforcement actions against various cryptocurrencies, arguing that they should be classified as securities.

On the other hand, companies like Coinbase and Binance argue that most cryptocurrencies do not fit the definition of securities under U.S. law.

In this article, we will explore the criteria that define a cryptocurrency as a security under U.S. law.

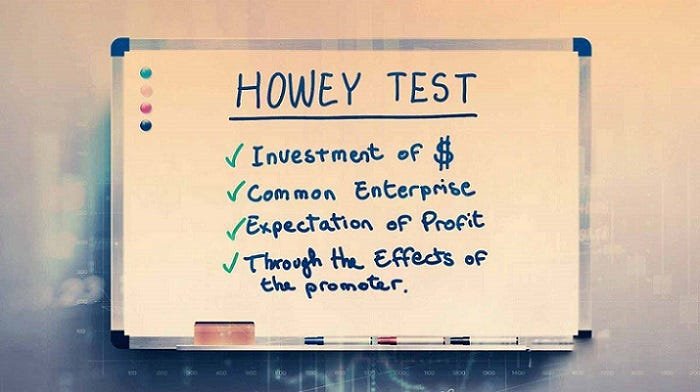

We will delve into the famous Howey Test and its implications for various cryptocurrencies. Additionally, we will discuss the distinction between commodities and securities in the crypto market.

By the end, you will gain a comprehensive understanding of the ongoing debate surrounding the classification of cryptocurrencies as securities.

Why should care if a cryptocurrency is deemed a security?

Imagine the potential consequences if a cryptocurrency is labeled a security – your investments could be subject to strict regulations and detailed disclosures, leaving you feeling trapped and suffocated by bureaucracy.

The designation of a cryptocurrency as a security would mean that it is treated as a traditional financial instrument, falling under the purview of securities laws.

This would require companies issuing or trading the cryptocurrency to comply with a range of regulatory requirements, such as registration with the SEC, providing extensive disclosures, and adhering to strict reporting standards.

The classification of a cryptocurrency as a security can have significant implications for investors, companies, and the overall industry.

While it may provide increased investor protection and market stability, it could also hinder innovation and impose burdensome regulatory requirements.

It is important for regulators, lawmakers, and industry participants to carefully consider the potential consequences and strike a balance between investor protection and fostering innovation in the cryptocurrency market.

Which cryptocurrencies are labeled a securities?

Consider the potential ramifications if a cryptocurrency were to be categorized as a security, as it would subject certain digital assets to the stringent regulations and oversight of securities laws.

In the lawsuits against Binance and Coinbase, the SEC has listed 19 cryptocurrencies as securities – excluding Ethereum.

These lawsuits have raised concerns about Wall Street’s potential dominance and the classification of certain cryptocurrencies as securities.

The SEC’s list of alleged securities includes 61 different cryptocurrencies, representing over $100 billion of the crypto market.

It is worth noting that the SEC Chairman has suggested that everything other than Bitcoin could potentially be considered a security.

The outcome of these lawsuits will not only set new precedents but also shape future legislation in the crypto industry.

Critics argue that applying the Howey Test, an antiquated legal framework, to digital assets is inadequate and restrictive.

The Howey test is a legal test used in the United States to determine whether a transaction qualifies as an investment contract and, thus, is considered a security under federal law.

Coin Telegraph

As the crypto market continues to evolve, it becomes increasingly important to find a balance between investor protection and innovation in order to foster a thriving and regulated market.

What makes a crypto asset a security in the U.S.?

To understand what qualifies a crypto asset as a security in the U.S., it’s crucial to delve into the specific criteria and regulations set forth by the SEC.

The SEC considers a crypto asset to be a security if it meets the definition of an ‘investment contract‘ under the Securities Act of 1933.

According to the Howey Test, which is used by the SEC to determine if an investment contract exists, a crypto asset is deemed a security if it involves an investment of money in a common enterprise with the expectation of profits solely from the efforts of others.

In simpler terms, if individuals invest money in a crypto asset with the expectation of making a profit primarily from the work of others, then it is likely to be classified as a security.

This means that the SEC can subject the asset to strict regulations and require detailed disclosures.

However, it’s important to note that not all crypto assets fall under the security classification.

For example, Bitcoin is not considered a security because the profits obtained from it are not dependent on the efforts of developers or managers. Each crypto asset must be evaluated on a case-by-case basis to determine if it meets the criteria set by the SEC.

What Is the Howey Test?

You might be wondering, ‘What exactly is the Howey Test?’ Well, let me break it down for you.

The Howey Test is a legal test created by the Supreme Court in 1946 to determine whether an investment contract qualifies as a security under U.S. federal securities laws.

It is named after the case Howey v. SEC, which established the test.

Here are three key points to consider:

- The Howey Test consists of four elements that must be met for an investment contract to be considered a security. These elements are:

- 1) an investment of money,

- 2) in a common enterprise,

- 3) with an expectation of profits,

- 4) solely from the efforts of others.

- The test focuses on the economic reality of the transaction rather than its form or label. It aims to identify situations where people are investing money with the expectation of profits based on the efforts of others.

- The Howey Test has been applied to various investment schemes, including real estate ventures, partnerships, and even certain cryptocurrency offerings. It provides a framework for regulators and courts to assess whether a particular investment falls within the definition of a security.

Understanding the Howey Test is crucial in determining whether a crypto asset qualifies as a security under U.S. securities laws. By applying this test, regulators and courts can evaluate whether an investment contract involves the essential elements that make it a security.

The Ineluctable Modality

A new paper titled ‘The Ineluctable Modality‘ provides a framework to distinguish cryptoassets that are securities from those that are not.

It argues that fungible cryptoassets should not be considered securities under existing U.S. federal securities laws. Instead, it suggests a different approach that separates capital raising transactions from the treatment of the cryptoasset itself.

According to the paper, investment contracts that involve capital-raising transactions by project sponsors and insiders should be subject to federal securities laws.

However, the cryptoasset sold under the investment contract should not be considered a security. This approach avoids the need for an asset to change its security status over time.

Overall, the paper offers a more elegant and practical solution for classifying cryptoassets under securities laws.

It provides clarity and guidance for pending cases without harming the cryptoasset markets and investor value. It also highlights the need for new legislation to close regulatory gaps and better regulate the crypto industry.

Why Ethereum is not a security?

Now let’s delve into why Ethereum isn’t considered a security and what factors contribute to this classification.

The Securities and Exchange Commission (SEC) has been hesitant to clearly classify Ethereum as a security.

While the SEC has filed a lawsuit against Binance and labeled several tokens as unregistered securities, they have avoided addressing the status of Ethereum.

This could be because Ethereum is commonly held as an investment and is widely used as a medium of exchange.

There are a few potential reasons for the SEC’s reluctance to classify Ethereum as a security.

One factor may be the SEC’s previous inaction after the DAO hack, where millions of dollars worth of Ethereum were stolen.

This incident may have influenced SEC Chair Gary Gensler’s stance on Ethereum.

Another possibility is that Gensler, who has a background in traditional finance, may have a limited understanding of the technology behind Ethereum.

The lack of clear legal definitions for Layer 1 tokens like Ethereum leaves investors in regulatory limbo.

Without proper regulation, investors and industry participants are unsure of their rights and obligations.

In order for the crypto industry to advance, it is crucial to have authentic and open-ended discussions about the classification of digital assets like Ethereum.

The SEC’s reluctance to classify Ethereum as a security has left it in a regulatory gray area.

Clear legal definitions and discussions are necessary to provide clarity and guidance for investors and industry participants.

Is Bitcoin a security?

Although you may have heard arguments suggesting otherwise, it’s important to understand that Bitcoin isn’t considered a security.

This is due to its decentralized nature and the fact that investor profits aren’t reliant on developers or managers. Here are three key reasons why Bitcoin isn’t classified as a security:

- Decentralization: Bitcoin operates on a decentralized network. There is no central authority or entity controlling its transactions. This distinguishes it from securities, which typically involve centralized control and reliance on a specific organization. The absence of a central authority in Bitcoin reduces the risk of manipulation or influence on investor profits.

- Independence from Developers and Managers: Unlike securities, where investor profits can be influenced by the actions or decisions of developers and managers, Bitcoin’s value is determined by market demand and supply dynamics. Investors in Bitcoin aren’t dependent on any specific individuals or entities to generate returns, further contributing to its non-security status.

- Lack of Investment Contract: Securities often involve investment contracts, where investors provide capital to a project or company with the expectation of profits. However, Bitcoin doesn’t involve any such investment contract. It is a decentralized digital currency designed for peer-to-peer transactions, not for raising capital through investment contracts.

These factors contribute to the classification of Bitcoin as a non-security, highlighting its unique characteristics and distinguishing it from traditional securities regulated by the U.S. Securities and Exchange Commission.

What is the difference between a commodity and a security?

Understanding the distinction between a commodity and a security is crucial in navigating the complexities of financial markets and regulatory frameworks.

While both commodities and securities are types of investments, they have distinct characteristics and are subject to different regulations.

A commodity refers to a raw material or primary agricultural product that can be bought and sold, such as gold, oil, or wheat. These commodities are typically traded on exchanges and their value is determined by supply and demand factors. Commodity markets are often driven by factors such as weather conditions, geopolitical events, and global economic trends.

On the other hand, a security represents an ownership interest or a financial claim on an underlying asset or company. This can include stocks, bonds, or investment contracts. Securities are typically regulated by securities laws and require detailed disclosures to protect investors. The value of securities is influenced by factors such as company performance, market conditions, and investor sentiment.

While cryptocurrencies like Bitcoin are often referred to as digital assets, whether they are classified as commodities or securities is a subject of debate and regulatory scrutiny.

The classification depends on various factors, including the nature of the cryptocurrency, the manner in which it is offered and sold, and the rights or benefits it provides to investors.

The distinction between commodities and securities lies in their underlying assets, trading mechanisms, and regulatory frameworks.

Understanding this difference is essential for investors, regulators, and market participants to properly assess and navigate the evolving landscape of cryptocurrencies and financial markets.

Frequently Asked Questions

What are some arguments against labeling cryptocurrencies as securities under U.S. law?

Arguments against labeling cryptocurrencies as securities under U.S. law include the assertion that most cryptocurrencies do not fit the definition of securities, the need for clearer regulations, and the criticism of the SEC’s inconsistent determinations.

How does the SEC determine whether a crypto asset is a security?

The SEC determines whether a crypto asset is a security by applying the decentralize-and-morph approach. This theory considers factors like decentralization and economic incentives. However, it has been inconsistent and confusing, leading to calls for a better approach to classify cryptoassets.

Are there any specific crypto assets that have been determined to be securities by the SEC?

Yes, the SEC has determined that specific crypto assets are securities. For example, in the case against Ripple Labs, the SEC argues that XRP is a security. Other cases have also resulted in the determination that certain crypto assets are securities.

What is the Howey Test and how does it relate to determining whether a crypto asset is a security?

The Howey Test is a legal framework used to determine whether a crypto asset qualifies as a security. It examines whether there is an investment of money in a common enterprise with an expectation of profits solely from the efforts of others.

What is the difference between a commodity and a security in the context of cryptocurrencies?

In the context of cryptocurrencies, the difference between a commodity and a security lies in their classification and regulation. While commodities are typically tangible goods or raw materials, securities refer to financial instruments that represent ownership or investment in a company.

Bottom Line

In conclusion, the debate over whether cryptocurrencies should be classified as securities is a complex and significant issue.

The SEC’s classification of crypto assets as securities has far-reaching implications for the industry and market participants.

While the decentralization theory may have its limitations, it’s important to consider alternative approaches, such as the separation of capital-raising transactions from the treatment of crypto assets.

Symbolically, this approach could strike a balance between regulatory oversight and the innovation and growth of the crypto industry, ultimately benefiting all stakeholders involved.

Read Next

- Democratic Candidate Robert Kennedy Pledges Bold Economic Plan Backed by Gold and Bitcoin

- What Is Batch Token Transfer And How Does It Work?

- G20 Financial Stability Board Sets Global Safeguards for Cryptocurrency Companies, Urging Compliance and Accountability

- G20 Financial Stability Board Sets Global Safeguards for Cryptocurrency Companies, Urging Compliance and Accountability

- Analyzing Potential Factors and Projected Trends for XRP

- Introducing ChainGPT Pad, an AI-focused Launchpad Released by ChainGPT

Previous Articles:

- Democratic Candidate Robert Kennedy Pledges Bold Economic Plan Backed by Gold and Bitcoin

- What Is Batch Token Transfer And How Does It Work?

- G20 Financial Stability Board Sets Global Safeguards for Cryptocurrency Companies, Urging Compliance and Accountability

- Analyzing Potential Factors and Projected Trends for XRP

- Introducing ChainGPT Pad, an AI-focused Launchpad Released by ChainGPT