Imagine diving into a world where currency knows no boundaries, where transactions are seamless and secure. Welcome to the realm of cryptocurrencies, a digital landscape that is revolutionizing the way we invest.

In this article, we will explore 14 compelling reasons why cryptocurrencies are an excellent investment choice. From potential high returns to diversification opportunities and increased transparency, these digital assets offer a promising future for those seeking financial growth and innovation.

So why wait? Let’s delve into the fascinating world of cryptocurrencies and discover their investment potential together.

Table of Contents

Are cryptocurrency a good investment?

Cryptocurrencies can be a good investment for several reasons. Let’s explore why cryptocurrencies are a good investment?

1. Potential for High Returns

Over the years, cryptocurrencies have demonstrated their ability to generate substantial profits within relatively short spans of time.

This is primarily due to the volatile nature of these digital assets, which allows for rapid price fluctuations and opportunities for profit-making.

However, it is important to note that investing in cryptocurrencies does come with its fair share of risks. The market can be highly unpredictable, and prices can experience sharp declines just as quickly as they rise.

Therefore, it is crucial for investors to conduct thorough research and stay informed about market trends before making any investment decisions.

By doing so, investors can increase their chances of capitalizing on the potential high returns offered by cryptocurrencies.

2. Diversify Your Portfolio

Including cryptocurrencies in an investment portfolio can help diversify risk and enhance returns.

Cryptocurrencies like Bitcoin and Ethereum often have low correlations with traditional assets such as stocks and bonds.

This means that when traditional assets decrease in value, cryptocurrencies may not be affected or may even increase.

Diversifying with cryptocurrencies spreads investments across different asset classes, reducing the impact of any single investment. This protects against market volatility and potential losses.

3. An Easy Accessible Investment

One of the advantages of cryptocurrency investment is its accessibility to a wide range of individuals with internet access.

Unlike traditional financial markets, which often require significant capital or specialized knowledge, anyone with an internet connection can participate in cryptocurrency investment.

This ease of access has democratized the financial market, allowing people from all walks of life to invest and potentially benefit from the growth of cryptocurrencies.

The accessibility of cryptocurrency investment is particularly beneficial for those who may have limited resources or experience in traditional investing.

With just a few clicks, individuals can open an account on a cryptocurrency exchange platform and start buying and selling digital assets.

There are also various resources available online that provide information and educational materials to help newcomers navigate the world of cryptocurrencies.

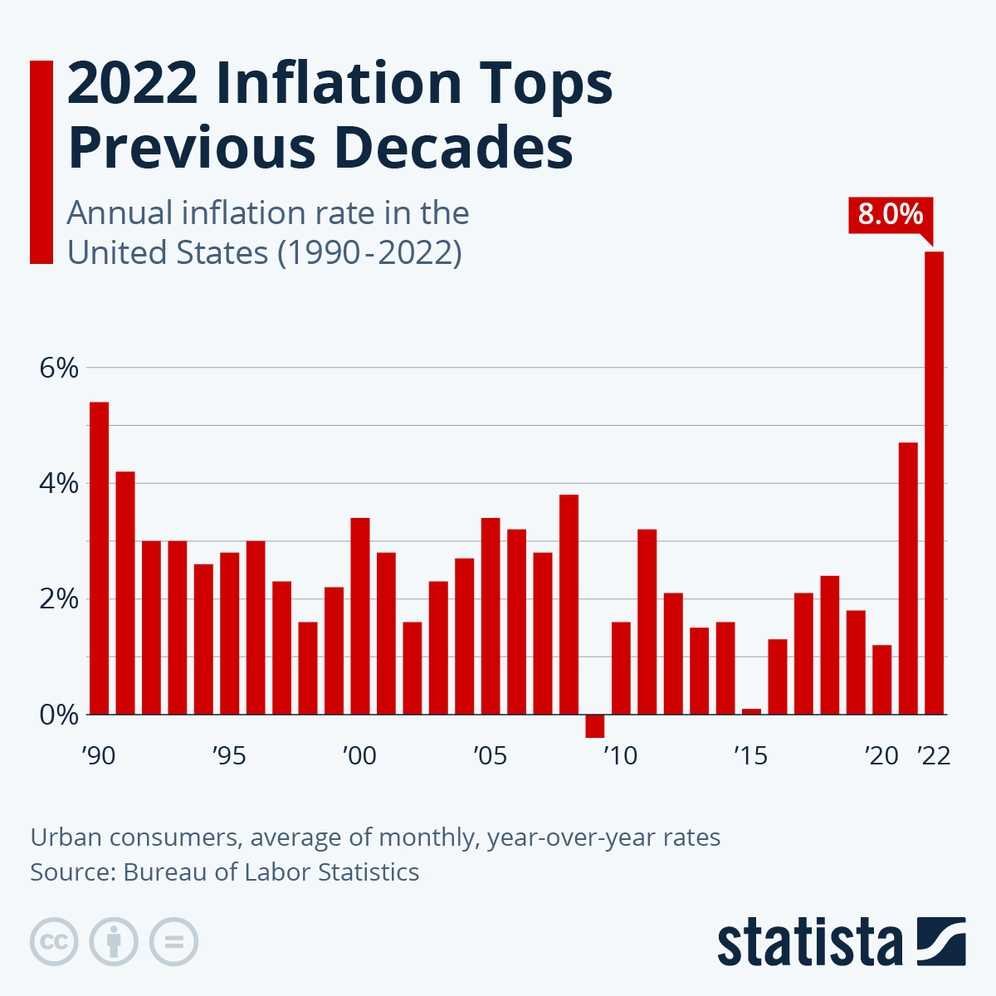

4. Hedge against Inflation

The capped supply of cryptocurrencies like Bitcoin can serve as a hedge against traditional fiat currency inflation.

Their issuance is not controlled by central banks, unlike fiat currencies that can be printed and devalued at will.

The limited supply of cryptocurrencies ensures that their value cannot be diluted in the same way. This makes cryptocurrencies an attractive investment for those seeking protection against potential inflationary pressures on traditional currencies.

Furthermore, the finite number of coins that will ever be mined creates scarcity. This scarcity can drive up demand and increase their value over time.

As investors recognize the potential benefits of owning a decentralized digital asset with a capped supply, cryptocurrencies like Bitcoin continue to gain popularity as an alternative investment option in today’s uncertain economic landscape.

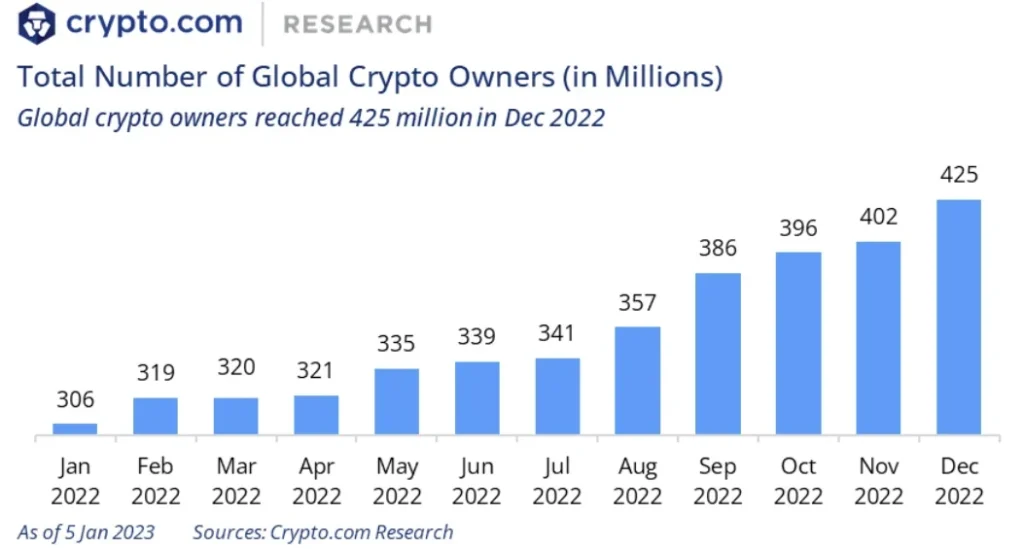

5. Growing Adoption Across The World

As you explore the growing adoption of cryptocurrencies across the world, you’ll discover a multitude of industries and individuals embracing this digital revolution. Cryptocurrencies offer several advantages that make them an attractive investment option.

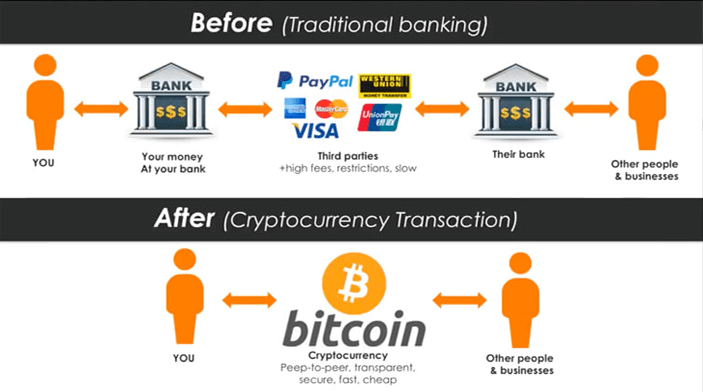

Firstly, they provide a decentralized alternative to traditional financial systems, allowing for greater transparency and efficiency in transactions.

Additionally, cryptocurrencies have the potential to increase financial inclusion by providing access to banking services for the unbanked population.

Moreover, as more businesses accept cryptocurrencies as a form of payment, their value and utility continue to grow.

This widespread acceptance is evident from major companies like Tesla and PayPal integrating cryptocurrency into their operations.

Furthermore, governments are also recognizing the importance of cryptocurrencies and exploring ways to regulate them effectively.

With such broad adoption and support from various sectors, it becomes increasingly clear why cryptocurrencies are considered a good investment opportunity in today’s evolving financial landscape.

6. Early-Stage Market

Now that we have explored the growing adoption of cryptocurrencies across the world, let’s delve into another reason why they are a good investment: the early-stage market.

As mentioned earlier, the cryptocurrency market is still relatively young, offering unique opportunities for investors.

Being in its early stages means that there is plenty of room for growth and innovation as technology and market dynamics continue to evolve. This presents a chance for early adopters to potentially benefit from long-term growth as the industry matures.

Additionally, with an early-stage market comes the potential for higher returns on investment compared to more established markets.

7. You’ll learn new skills

By investing in cryptocurrencies, you’ll gain new skills that can be applied to various areas of your life. The world of crypto investing is not just about buying and selling digital currencies; it requires research, analysis, and decision-making based on market trends and indicators.

As you delve into this realm, you’ll learn how to read charts, interpret data, and understand market psychology.

These skills are not limited to cryptocurrency trading alone; they can be applied to other financial markets or even everyday situations.

Additionally, navigating the volatile nature of the crypto market will teach you emotional self-control, discipline, and patience – qualities that can benefit you in all aspects of life.

So while cryptocurrency investment may not guarantee wealth, the knowledge gained is invaluable and can make a significant difference in your overall financial literacy.

8. Low entry threshold

With a low entry threshold, you can

Cryptocurrency trading allows you to buy and sell digital currencies with ease, without the need for complicated paperwork or procedures. It offers a simple and straightforward way to get started in the investment world.

9. Censorship-Resistant

If you’re looking for a way to protect your financial transactions from government censorship and control, cryptocurrency can provide a solution.

Unlike traditional forms of payment, cryptocurrencies operate on decentralized networks that are resistant to censorship. This means that no single authority or government can dictate how you use your funds or freeze your assets.

Transactions made with cryptocurrencies are recorded on a public ledger called the blockchain, which ensures transparency and prevents tampering. Additionally, the cryptographic nature of these digital currencies ensures the security and integrity of each transaction.

By using cryptocurrencies, you can maintain control over your finances without worrying about interference from external entities. It offers an alternative financial system that empowers individuals and promotes economic freedom in an increasingly digital world.

10. You can quickly enter-exit positions

When you want to quickly enter or exit positions, cryptocurrency allows you to easily sell your investments and access your cash instantly. This is one of the key advantages of investing in cryptocurrencies.

Unlike traditional investment options like stocks or real estate, where it can take days or even weeks to liquidate your position and receive your funds, cryptocurrencies offer a much faster process. With just a few clicks, you can sell your digital assets and have the cash available for use immediately.

This flexibility is especially beneficial in volatile markets where quick decision-making can make a significant difference.

Whether you need to seize an opportunity or cut losses, the ability to swiftly enter or exit positions is a valuable feature that attracts many investors to cryptocurrencies.

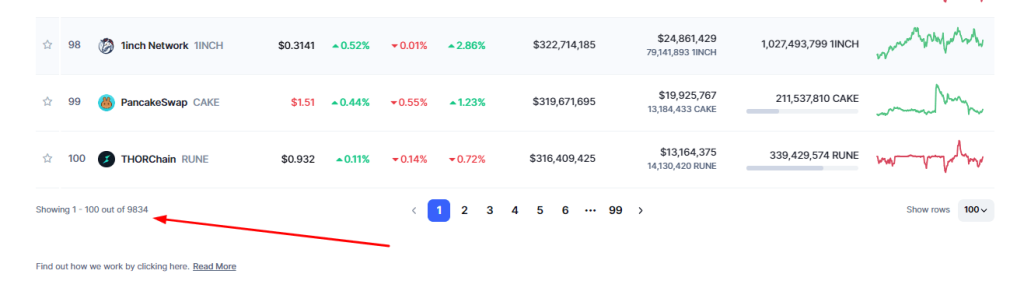

11. You have a vast range of choices

The vast range of choices in the cryptocurrency market allows investors to diversify their portfolios and explore various investment options. With over 9000 cryptocurrencies available, you have the freedom to choose from a wide array of assets that suit your investment goals and risk tolerance.

This diversity provides opportunities for investors to access different sectors, technologies, and strategies within the crypto industry. By investing in multiple cryptocurrencies, you can spread your risk and potentially benefit from the growth of various projects.

Additionally, having a vast range of choices allows you to stay updated with new developments in the market and adapt your investment strategy accordingly.

Whether you prefer well-established coins or emerging tokens with potential, the variety of options gives you the flexibility to tailor your investments to your preferences and objectives.

12. Fast Transaction speeds

As mentioned earlier, cryptocurrency transactions can be completed in a matter of minutes. This is incredibly advantageous compared to traditional financial services, where domestic wire transfers can take hours or even days.

Furthermore, international money transfers often come with exorbitant fees and lengthy processing times. Cryptocurrency transactions, on the other hand, are not only faster but also cost significantly less.

While transaction costs may increase during periods of high demand on the blockchain, they still tend to remain lower than wire transfer fees.

With such impressive transaction speeds and cost effectiveness, cryptocurrencies offer an efficient and convenient way to move funds globally.

13. Have Total Control Over Your Investment

With cryptocurrencies, you can have complete control over your investment through the use of a private key. This means that only you have access to your crypto assets and can manage them as you see fit.

Governments or federal agencies cannot manipulate the value of cryptocurrencies because they do not have control over them. By holding a private key, you have the power to buy, send, and receive cryptocurrencies at your own discretion.

This level of control is significant because it empowers individuals to make independent decisions regarding their investments without relying on intermediaries or centralized authorities.

Additionally, having total control over your investment allows for increased security and peace of mind knowing that your assets are safe from potential external influences.

14. You are investing in innovation

Investing in innovation means you can be at the forefront of cutting-edge technology and potentially reap the benefits.

Cryptocurrencies offer an opportunity to invest in a revolutionary technology that has the potential to reshape industries and enhance efficiency.

Blockchain, the underlying technology behind cryptocurrencies, introduces a decentralized system that ensures transparency, security, and immutability of data. This innovation has the power to transform traditional sectors such as finance, supply chain management, healthcare, and more.

By investing in cryptocurrencies, you become part of this technological revolution and have the chance to support groundbreaking projects that are pushing boundaries.

Moreover, as blockchain continues to evolve and mature, new applications and use cases will emerge, creating even more opportunities for investors.

Being ahead of the curve allows you to tap into these innovations early on and potentially realize significant returns on your investment.

How much money should you Invest?

To determine how much money you should put into cryptocurrencies, consider your financial goals and risk tolerance.

Investing in cryptocurrencies can be exciting, but it is important to approach it with a rational mindset.

Assess your current financial situation and determine how much you can afford to invest without jeopardizing your overall financial stability.

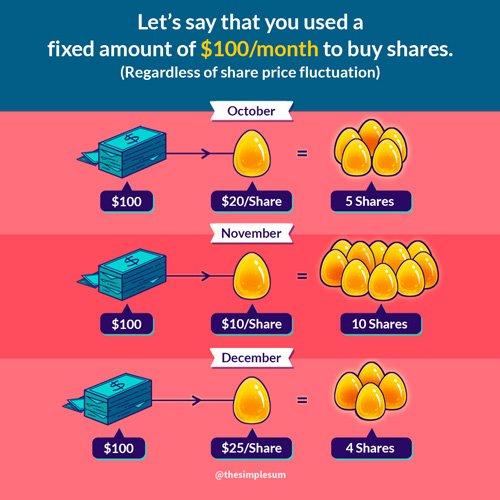

Once you have a clear understanding of your financial stability, it’s time to consider the concept of dollar-cost averaging (DCA) for your cryptocurrency investments.

DCA is a strategy where you invest a fixed amount of money at regular intervals, regardless of the current price of the asset. This approach helps reduce the impact of market volatility and allows you to buy more units when prices are low and fewer units when prices are high.

As a general rule of thumb, it is recommended to allocate only 10% of your total income to investments in general.

For example, if your total monthly income is $2,000, you would allocate only $200 (10% of $2,000) for investments. This amount can then be divided further into smaller, regular contributions to specific cryptocurrency to implement the dollar-cost averaging strategy.

Remember that the cryptocurrency market can be highly unpredictable and subject to rapid price fluctuations. Therefore, invest only what you can afford to lose without adversely affecting your essential financial commitments, such as rent, bills, groceries, and emergency savings.

Which platform to use for investing in crypto?

When considering which platform to use for investing in crypto, it’s important to research and compare the features and fees of different platforms like Binance, Kucoin, and TradeSanta.

These platforms offer various benefits and functionalities that can suit different investment strategies.

Binance , for example, is one of the largest cryptocurrency exchanges globally, offering a wide range of cryptocurrencies to trade with low fees.- Kucoin, on the other hand, focuses on providing a user-friendly interface and a diverse selection of altcoins.

- Meanwhile, TradeSanta offers automated trading bots that can execute trades based on predetermined strategies.

By understanding the unique features offered by each platform, you can make an informed decision that aligns with your investment goals and preferences.

Which Cryptocurrency Should You Invest In?

If you’re looking to invest in cryptocurrency, the next step is deciding which one to choose. Although not financial advisors, here are some promising options:

- Bitcoin (BTC) and Monero (XMR) stand out due to their limited supply, which can potentially drive up their value over time.

- Ethereum (ETH) is another promising option, as it’s being widely adopted for building the new financial order.

- Additionally, Ripple (XRP), Solana (SOL), Polkadot (DOT), and Polygon (MATIC) are great alternatives that have gained attention in the crypto market.

Each of these cryptocurrencies has its own unique features and potential for growth.

To make an informed decision, it’s essential to research each option thoroughly and consider factors such as market trends, technological advancements, and long-term viability.

By carefully evaluating these factors, you can determine which cryptocurrency aligns best with your investment goals.

Frequently Asked Questions

Are cryptocurrencies a safe investment option?

Cryptocurrencies can be a risky investment due to their high volatility and lack of regulation. However, they offer potential for high returns and diversification. It’s important to research and understand the risks involved before investing.

What are the potential risks involved in investing in cryptocurrencies?

Investing in cryptocurrencies comes with several potential risks. One such risk is the high volatility of the market, which can lead to significant losses. Additionally, there is a lack of regulation and security concerns that make investing in cryptocurrencies risky.

How do I decide when to buy or sell cryptocurrencies?

To decide when to buy or sell cryptocurrencies, consider factors like market trends, price movements, and your investment goals. Conduct thorough research, monitor news updates and seek advice from experts for informed decision-making.

Are there any regulations or legal considerations to keep in mind when investing in cryptocurrencies?

There are regulations and legal considerations to keep in mind when investing in cryptocurrencies. For example, the US Securities and Exchange Commission has stated that some digital assets may be classified as securities and subject to certain rules.

What are the tax implications of investing in cryptocurrencies?

When investing in cryptocurrencies, it is important to consider the tax implications. Cryptocurrency investments are subject to capital gains tax, and you may be required to report your earnings and pay taxes accordingly.

We suggest you read this article we wrote a while back ago about cryptocurrency taxes.

Final Take

In conclusion, cryptocurrencies can be a golden opportunity for you to diversify your investment portfolio and potentially reap substantial rewards.

With their decentralized nature and innovative technology, they offer a pathway to financial independence.

Just like a rising phoenix, these digital assets have the potential to soar high in value, providing you with a chance to make your dreams take flight.

So seize this chance and embark on a journey that could lead you towards an abundant future.

🔴 LATEST POSTS

- HashKey Exchange Announces Official Uplift of Type 1 and Type 7 Licences, Becoming the First Licensed Exchange for Retail Users in Hong Kong

- Top 7 VCs Investing in Bitcoin Businesses

- Opinion: Bitcoin’s Lightning Network Can Power Up AI-Driven Shopping

- SEC’s Sweeping Move: Coinbase Ordered to Halt Altcoins Trading, Crypto Industry Faces Regulatory Crossroads

- Putin Launches Digital Ruble: Russia’s Leap into the Crypto-Future Amidst Sanctions

Previous Articles:

- HashKey Exchange Announces Official Uplift of Type 1 and Type 7 Licences, Becoming the First Licensed Exchange for Retail Users in Hong Kong

- Top 7 VCs Investing in Bitcoin Businesses

- Opinion: Bitcoin’s Lightning Network Can Power Up AI-Driven Shopping

- SEC’s Sweeping Move: Coinbase Ordered to Halt Altcoins Trading, Crypto Industry Faces Regulatory Crossroads

- Putin Launches Digital Ruble: Russia’s Leap into the Crypto-Future Amidst Sanctions