This article explains how the global bond market operates like a confidence game, why government manipulation of these markets signals trouble ahead, and what smart investors are doing to protect their wealth.

By reading this, you’ll understand why traditional “safe” investments might not be so safe anymore and learn about the ongoing shift toward harder assets like Bitcoin.

The Big Bond Market Illusion

The fiat currency system = a system where money isn’t backed by gold or any physical asset, just government promises.

And right now, that system is showing cracks bigger than the Grand Canyon.

The whole thing runs on confidence. Not economics, not fundamentals – just pure belief.

It’s like Tinkerbell, except instead of clapping to save a fairy, everyone’s clapping to keep their retirement funds from evaporating.

When Central Banks Became the Biggest Buyers in Town

Remember 2008? That financial crisis was supposed to be the wake-up call. The system needed a massive reset, but governments and central banks decided that was too painful. So what’d they do? They started buying their own bonds like crazy.

Bonds = IOUs from governments. When you buy a government bond, you’re basically lending money to the government. They promise to pay you back with interest after a certain time. Investors traditionally loved them because governments (supposedly) always pay back their debts.

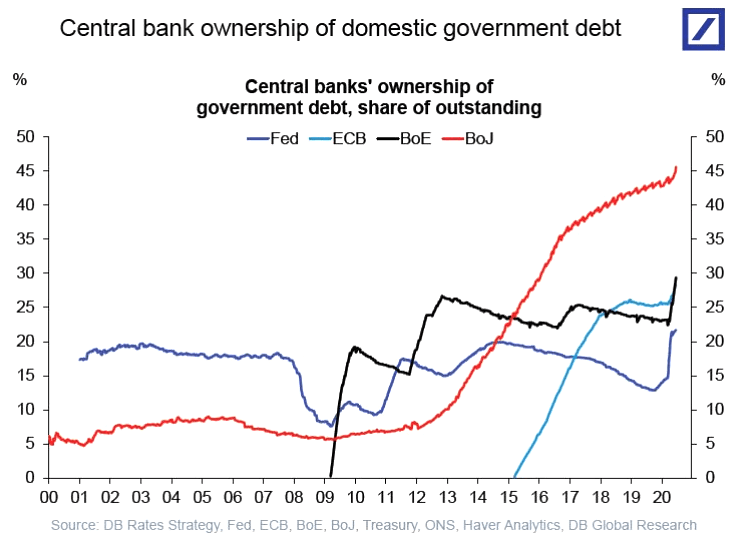

Check out these wild numbers:

- Bank of Japan owns about 50% of Japanese government bonds [1]

- European Central Bank holds around 30% of European bonds [2]

- Federal Reserve has about 13% of US bonds [3]

“But wait, isn’t that like writing yourself a check?”

Yeah, pretty much. They’re monetizing the debt = creating new money to buy government bonds, which props up prices and keeps interest rates artificially low.

The Boomer Blind Spot

Here’s where it gets spicy. The Boomer generation made bank on stocks and real estate for decades. They thought they were investment geniuses.

- $100 invested in 1980 would be worth $14,761 by 2025, representing an 11.67% annual return. [4]

- Housing prices increased 393% from 1985-2019. [5]

- Average Boomer in their 30s (1985) paid $82,800 for a home, while Millennials in their 30s (2019) paid $313,000. [6]

Meanwhile, they laughed at Bitcoin’s volatility while treating government bonds as the ultimate safe investment.

(Ed. note: This isn’t about generational warfare – it’s about recognizing investment paradigms that no longer work)

They missed one critical fact: their “safe” bonds have been losing purchasing power for years.

Sure, you might get your principal back, but what can that money actually buy? A lot less than when you started.

The Stealth Default Nobody Talks About

Governments with their own currencies technically can’t default on bonds – they can always print more money.

The sneaky part is they’re defaulting through currency debasement = making each dollar worth less over time.

It’s been subtle enough to maintain confidence. Like a magician’s sleight of hand, most people don’t notice the trick until it’s too late.

The Great Rotation Is Starting

Something’s changing though. More investors are catching on to the bond market shenanigans. The shift in awareness represents a pivotal moment for alternative assets.

Where’s the smart money going? Into harder assets:

- Stocks (at least they represent ownership in real companies)

- Gold (the OG store of value)

- Crypto (the new kid on the block)

And Bitcoin? As the hardest asset of them all – an asset with a fixed supply that can’t be inflated away – it’s positioned to outperform everything else.

Why Financial Repression Won’t Save the Day

Central banks and treasuries have plenty of tools to suppress bond yields and maintain the illusion. They’ll use “financial repression” = policies that keep interest rates below inflation to slowly erode government debt burdens.

Once investors understand the game, they start looking for exits. And when trillions of dollars start rotating out of bonds, even the best magicians run out of tricks.

The Paradigm Shift That’s Already Happening

Major shifts in investment thinking don’t happen overnight. They come with volatility, uncertainty, and plenty of people clinging to old ideas.

We’re watching conventional investment wisdom get turned on its head. The “safe” assets aren’t safe. The “risky” assets might be the only real protection against currency debasement.

“So you’re saying I should dump all my bonds and buy Bitcoin?” – Not exactly.

But understanding this shift means recognizing that the old playbook might leave you holding worthless paper while others preserve their wealth in harder assets.

The Aha Moment Is Coming

This isn’t doom and gloom – it’s reality. The bond market will keep functioning, yields will be managed, and life will go on. But underneath the surface, a massive reallocation of wealth is underway.

Investors who recognize this shift early will benefit. Those who keep believing in the magic of government bonds might find themselves victims of the greatest disappearing act in financial history.

The paradigm shift in macro dynamics is creating an enlightenment moment for Bitcoin and other hard assets. Once you see through the bond market’s illusion, you can’t unsee it.

And that changes everything about how you think about preserving wealth in a world of infinite money printing.

Bottom Line

The fiat system’s confidence game can continue for a while, but cracks are showing.

Central banks owning massive portions of their own bond markets isn’t normal or sustainable.

Currency debasement is the stealth default that’s already happening. And smart money is quietly rotating into assets that can’t be printed away.

The question isn’t whether this shift will happen – it’s already underway. The question is whether you’ll recognize it in time to protect your wealth.

Because when the music stops in this game of monetary musical chairs, you want to be holding something real, not just promises printed on fancy paper.

DISCLAIMER: This is an opinion article and BitNewsBot takes no responsibility for any financial decisions made based on this content. The author is not a financial expert and is not licensed to provide financial advice. The views expressed are personal opinions only and should not be considered professional investment guidance. Always conduct your own research and consult with qualified financial advisors before making any investment decisions.

Previous Articles:

- Crypto Traders Shift to CFDs for Security Amid 2025 Exchange Hacks

- Tom Brady Backs Catena Labs’ $18M Round for AI-Focused Finance

- Blockstream’s Adam Back Leads $2.2M Round for Sweden’s H100 Group

- Cetus DEX Hack: $223M Drained Due to Flawed AMM Overflow Check

- Off the Grid NFT Sales Surge as Steam Expansion Nears in June