Real-World Assets (RWAs) in crypto represent the tokenization of tangible and intangible assets from the physical and financial world, such as real estate, stocks, and commodities, on a blockchain.

This process improves liquidity, enables fractional ownership, and democratizes investment opportunities globally.

Through blockchain technology, RWAs offer transparent, secure transactions and reduce the need for intermediaries, streamlining the investment process.

The integration of RWAs into Decentralized Finance (DeFi) is poised to reshape the financial landscape, offering a glimpse into a future where traditional and digital finance converge, providing a wealth of new investment possibilities.

Table of Contents

Understanding Real-World Assets

Real-World Assets (RWAs) are “things” that have value in the real world. This includes physical items like houses and precious metals, financial items like stocks and government bonds, and even non-physical things like copyrights and environmental credits.

Tokenization of RWAs means turning these “things” into digital tokens on a blockchain, which allows more people to own a part of them and makes it easier to buy and sell.

Efficiency is enhanced through 24/7 trading capabilities, allowing fractional ownership of high-value assets. [1]

In addition, tokenization reduces fraud by creating a transparent and immutable record of ownership on the blockchain. [2]

The process of turning RWAs into tokens is complex. It involves figuring out what the asset is, making sure it follows all the rules, and choosing the right blockchain to use.

Creating the token and making sure it correctly represents the value of the real-world item requires careful attention to detail.

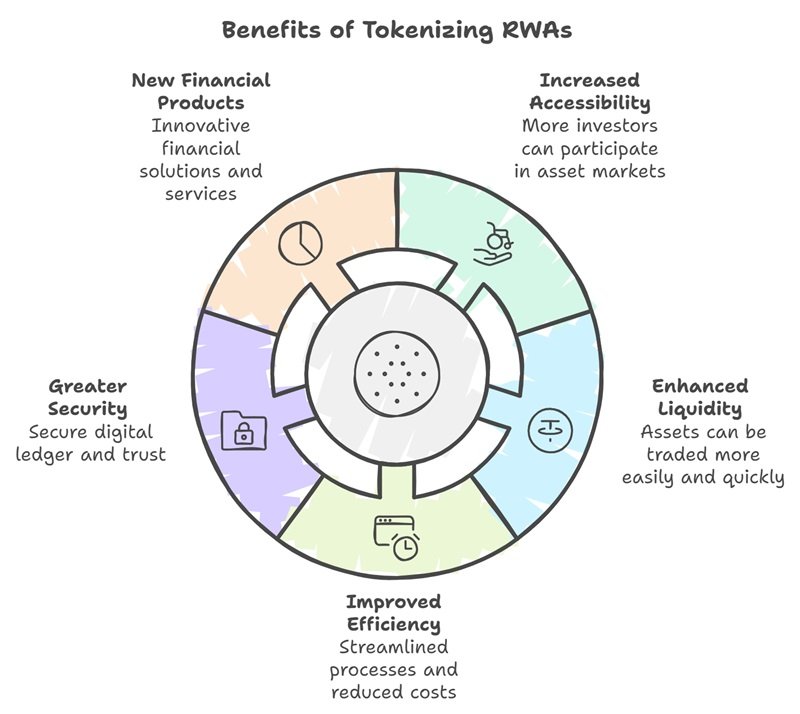

Benefits of Tokenizing RWAs

Turning real-world assets into digital tokens, known as tokenization, brings many benefits to the financial world.

It allows more people to invest in expensive assets by breaking them into smaller, more affordable pieces.

This means more people can invest, and it’s easier to buy and sell these assets because they can be traded online at any time, without needing a traditional broker.

Using blockchain technology makes the process faster and cheaper by reducing the need for middlemen.

Smart contracts, which are automatic digital agreements, make sure all the rules are followed and reduce mistakes. This technology also makes it easier and quicker to do business across different countries.

Everything is recorded on a secure digital ledger, which makes it easy to see who owns what and what transactions have taken place.

This increases trust and safety.

Moreover, increased liquidity means that assets that were previously difficult to sell can now be traded more easily, opening up new investment opportunities and potentially increasing their value. [3]

Enhanced efficiency is achieved by streamlining processes and reducing transaction costs, which in turn fosters innovation in financial products and services. [4]

As more big financial institutions start using tokenization, it will likely become a normal part of the financial system, leading to the creation of new financial products and expanding into new areas. This will make the financial world more efficient, accessible, and secure for everyone.

Types and Examples of RWAs

As mentioned earlier, Real-world assets (RWAs) are things that have value in the real world.

They can be divided into four main types:

- Physical assets: These are things you can touch, like houses, land, gold, silver, crops, and pieces of art.

- Financial assets: These are investments, such as stocks (pieces of a company), bonds (loans to a company or government), and other similar things. Tokenization of these assets can streamline the investment process, making it more accessible to a broader range of investors.

- Digital assets: These are things you can’t touch but exist in the digital world, like the rights to use software, data, music, or videos, as well as website domain names.

- Intangible assets: These are things that have value but you can’t touch them, like the rights to an invention, a brand name, or a book, as well as money from these rights and insurance policies.

Tokenized RWAs are when these assets are turned into digital tokens, which can be bought, sold, or traded online. This can include:

- Tokenized securities: Things like company and government investments, shares when a company first goes public, and the right to buy shares later at a set price.

- Tokenized commodities: Things like digital versions of gold, oil, farm products, special metals, and the right to pollute a certain amount.

- Tokenized art and collectibles: Things like famous paintings, sculptures, rare books, old furniture, and digital art.

- Tokenized real estate: Things like the right to own property, rental properties, investments in a group of properties, loans to buy a house, and property rights.

By turning these assets into tokens, it can be easier to buy and sell them, and more people can own a piece of them. This process enhances market liquidity, allowing for more efficient trading and broader participation in investment opportunities. [5]

RWAs in Decentralized Finance

As decentralized finance (DeFi) grows, adding real-world assets (RWAs) could significantly change global financial markets.

The traditional market, worth over $800 trillion USD, can be transformed by turning RWAs into digital tokens on a blockchain.

This change can make investing more liquid, meaning it’s easier to buy and sell investments, and reduce the steps and middlemen involved in transactions, making everything more efficient.

Using blockchain for these assets also makes things more transparent and safe, lowering the risk of someone not holding up their end of the deal. By moving into traditional areas of finance, like stocks and loans, DeFi can become a more important part of the global financial system.

Bringing RWAs into DeFi has many benefits. It can break assets into smaller pieces, allowing more people to invest, and it can improve access to markets around the world, making them more liquid.

RWA protocols can tap into the $1.6T private credit market and beyond, expanding the potential for growth. [6]

It also offers better opportunities for making money and allows for the creation of new financial products, like digital currencies backed by real-world assets, while making sure all the rules are followed using automated systems.

Platforms and Challenges in RWA Tokenization

Real-world asset (RWA) tokenization is changing the way we handle finances by making it easier to buy and sell things like buildings or even seats on an airplane.

Imagine being able to own a small piece of a big building without having to buy the whole thing. That’s what companies like Algorand, Koibanx, and Polymesh are helping to do.

They use something called blockchain, which is like a secure, online ledger, to break expensive things into smaller pieces that more people can afford.

This way, more people can invest and know exactly what they’re getting because everything is clear and safe.

These platforms are seeing significant market growth as more investors recognize the potential of RWAs. [7]

But, there are some hurdles to jump over. Laws are different everywhere, and it can be tricky to follow all the rules to make sure everything’s legal.

Also, the technology needs to be really strong and safe, so no one can cheat the system. The system also needs to be able to handle lots of people using it at once without slowing down.

It’s also important for regular financial folks to trust and use these tokenized pieces, and to make sure everything is super secure to keep all the investors happy and safe.

As this way of investing grows, we might see more integration with other internet-based finance systems, bigger companies getting involved, special markets becoming popular, and rules getting better to protect everyone involved.

Conclusion

Real-World Assets (RWAs) represent tangible and intangible assets that exist outside the digital domain, such as real estate, commodities, or intellectual property, which can be tokenized on a blockchain.

The tokenization of RWAs offers numerous benefits including increased liquidity, fractional ownership, and improved accessibility. In decentralized finance (DeFi), RWAs expand the ecosystem by integrating real-world value into digital platforms.

Despite regulatory and operational challenges, platforms like Polymath and Harbor are pioneering the tokenization of RWAs, heralding a more inclusive and efficient financial landscape.

Previous Articles:

- Cantor Fitzgerald Plans $2B Bitcoin Lending Program with Tether Partnership

- Bitcoin Rebounds After $2,000 Drop, $500M in Weekend Trading Liquidations

- Pac-Man’s 45th Anniversary Brings NFT Scavenger Hunt to Tokyo’s Shibuya

- Dogecoin Plunges 12% After Hitting Three-Year High of $0.475

- Google DeepMind’s AlphaQubit: AI System Makes Quantum Computing More Stable