Almost every week, Changpeng Zhao (CZ), the CEO of Binance, posts his infamous “4” tweet. This cryptic message refers to a pinned tweet in which he clarifies that whenever fake news or general FUD circulates about Binance, and he tweets “4,” people should not be concerned about said rumors.

The frequent use of the number four has led to its widespread recognition and embrace within the crypto community, with people sharing the number whenever there’s FUD in general.

The need to tweet “4” occurred yet again last week when CZ remained silent on Twitter for 24 hours. A tweet (see figure 2) from Pentoshi about CZ missing, although intended as satire, immediately caused fear online.

Immediately, people started speculating about the ongoing US Department of Justice (DoJ) investigation, with discussions emerging about potential market crashes if the DoJ decided to press charges against Binance and its executives. As a result, they demanded answers from CZ.

As it turned out, CZ was simply enjoying his Sunday, and the incident was yet another typical crypto storm in a glass of water. But the fact remains that there are many worries surrounding Binance, making the markets feel unsettled.

Issues with regulatory agencies

From the moment Binance was born, it stirred up a hornet’s nest with regulators. Launched in 2017, it already became the biggest crypto exchange in terms of volume and user base in 2018.

Its rise to prominence was driven by various factors, including a wide range of supported cryptocurrencies, low trading fees, user-friendly interface, and aggressive marketing strategies.

However, with its success, Binance also became an obvious target.

Regulatory criticism often focused on:

- Regulation and Compliance. One of the major worries about Binance stemmed from its operations in various jurisdictions without clear regulatory oversight. Cryptocurrencies and exchanges were relatively new phenomena, and regulations were still catching up to the fast-paced crypto industry. Many regulators raised concerns about the exchange’s compliance with anti-money laundering (AML) and Know-your-customer (KYC) regulations. With regulations finally catching up, Binance is sometimes forced to exit markets it has been operating in for years..

- Lack of Transparency. Critics pointed out that Binance’s operational structure and business practices were not as transparent as those of traditional financial institutions. The exchange faced criticism for not providing sufficient information about its management team, ownership structure, and financial audits. What’s even more concerning is that, as of today, the location of Binance’s headquarters remains unknown.

- Insider Trading Allegations. For a long time, ongoing accusations of insider trading on the Binance platform have persisted, with individuals being accused of profiting from advance knowledge of market movements. Binance has consistently denied any involvement in such practices.

CFTC and SEC both sue Binance

Regulatory scrutiny intensified after the collapse of FTX in November 2022. In March, the Commodity Futures Trading Commission (CFTC) filed a lawsuit against Binance and CZ for their alleged ‘willful evasion’ of U.S. laws and the offering of unregistered crypto derivatives products.

According to the CFTC, the global exchange, which includes a U.S. affiliate called Binance.US, devised a system to hide its true reach and operations in the U.S. The CFTC accused Binance of guiding U.S. customers to bypass compliance controls by using VPNs.

To add insult to injury, the U. S. Securities and Exchange Commission (SEC) also sued both Binance and its founder just a month later.

The allegations include Binance working to attract U.S. customers to its unregulated international exchange, violating securities laws, and commingling investor funds with their own. The SEC alleges that Binance.US is endangering $2.2 billion of U.S.-based clients’ funds.

Issues with law enforcement

It’s already widely known that the DoJ is investigating Binance for possible money laundering and criminal sanctions violations.

In February, Binance’s top spokesperson mentioned negotiations with the DoJ to settle legal issues. The proposed settlement involved fines and other measures to resolve past transgressions for which allegedly evidence has been gathered.

However, the deal never materialised. There are now speculations that the DoJ may be considering criminal charges against Binance and CZ.

The reasons for the deal falling apart are unclear, but many suspect that CZ resisted the settlement’s conditions, potentially involving him stepping down.

The suspicion grew stronger when several top executives decided to resign from Binance due to CZ’s handling of the DoJ investigation.

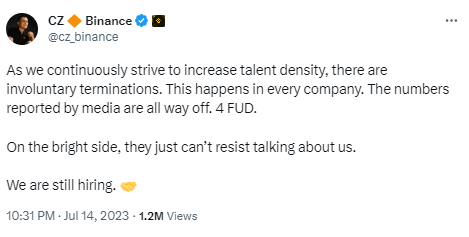

In response to the ongoing DoJ investigation and the overall uncertainty, Binance has confirmed it has begun laying off employees, affecting around 1,500 workers this year.

Insiders, however, claim up to 3,000 employees will lose their jobs. CZ continues to assert that the layoffs are the result of standard operations and that Binance also still hires new talent. As such, he blames the media for all of the recent FUD (figure 3).

FUD among traders

Although Binance has long been under the scrutiny of regulators, it has generally been perceived as a reliable exchange by traders. Why worry about an exchange that has consistently generated profits since its inception?

But things changed rapidly when the SEC accused Binance of mixing investor funds. The association with FTX and its subsequent downfall quickly made traders concerned about the safety of their funds on Binance.

FTX, the second-largest exchange at the time, commingled and misused customer deposits for trading purposes through Alameda Research. Alameda Research borrowed FTX users’ deposits and leveraged their own FTT token as collateral.

A report about FTX’s balance sheet by Coindesk, and ironically, a subsequent tweet by CZ (see figure 4) about Binance’s plan to sell FTT tokens, caused a sharp decline in the price of the token. When the FTT token significantly dropped in value, Alameda ended up defaulting on their loan to FTX.

As a result, users’ funds on FTX were no longer fully backed. Mass withdrawals from users followed, and shortly after, the exchange filed for bankruptcy. As a result, 8.9 billion dollars in user funds are still missing.

Binance denies mixing customer and company funds, stating they are kept on separate ledgers, despite the SEC’s allegations and the resulting FUD among traders.

Additionally, Binance has continuously released “proof-of-reserves” statements (which should not be mistaken for a genuine audit) aimed at reassuring users that their funds are fully backed. Despite their efforts, concerns persist.

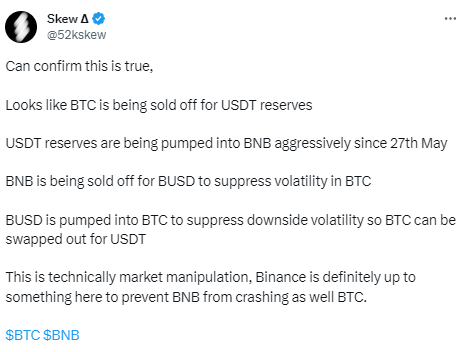

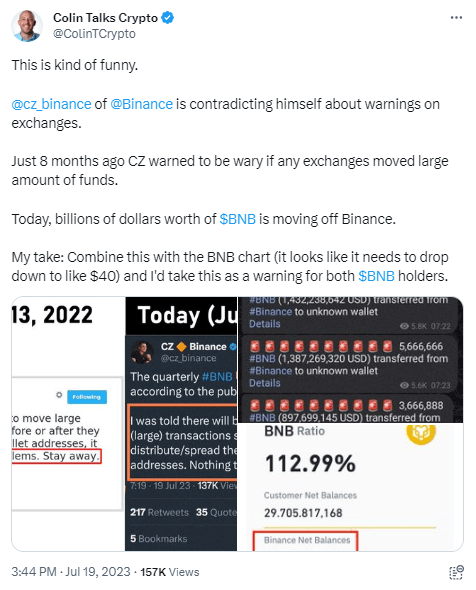

Traders have grown paranoid, and whenever similarities are observed between FTX and Binance, people promptly highlight them. For example, prominent influencers have already accused Binance of engaging in activities such as selling BTC and wash trading to artificially stabilize the price of its native coin $BNB (figure 5).

Binance’s decision last week to move billions of dollars worth of BNB off its exchange also raised eyebrows (figure 7).

Finally, there is a rumor circulating on Twitter that Sam Bankman-Fried, the former CEO of FTX who is now under arrest, possesses potentially damaging information about Binance.

It is believed that he might be actively cooperating with the DoJ in exchange for a significant reduction in the number of charges he will face.

My take on Binance’s position

Let’s again briefly review the above-mentioned challenges that Binance is facing, one by one.

First, the heightened regulatory scrutiny.

In the worst-case scenario, the SEC could emerge victorious. It would then impose significant fines on Binance, restrict crucial operations, and potentially subject its in-house BNB token to strict oversight.

Furthermore, CZ may face a permanent ban from operating the exchange or any financial firm.

Second, we have the DoJ. If the DoJ decides to prosecute Binance, it could potentially lead to imprisonment for some Binance executives.

Even in the event that Binance chooses to settle the DOJ’s allegations, it might result in a multi-billion dollar payment while still facing exclusion from the US banking system and some of its allies.

Third, we’ve got FUD among traders, fueled particularly by concerns that their funds may not be fully backed. As a result Binance’s market dominance, which reached an all-time high market share of 61.8% in February, has already declined significantly.

In June, its market share stood at “just” 41.9% of the total spot market. As more and more users turn to decentralized exchanges and other centralized platforms, it is anticipated that Binance’s market dominance will continue to diminish.

As such, even if Binance were to prevail against the SEC and avoid prosecution by the DoJ, the ongoing FUD among traders is already impacting its performance.

So yes, I do believe Binance is in a crisis, and that its survival depends on transparency and accountability—a task it is currently failing at.

To make matters worse, the negative sentiment surrounding Binance has had a spill-over effect on the sentiment of the entire crypto market.

Binance’s market share may be diminishing, it still remains the dominant exchange and holds custody of over 63 billion US dollars worth of user funds.

With that much at stake for both Binance and the entire crypto market, merely tweeting the number ‘4’ to downplay FUD is no longer enough.

About Author

I have experience in marketing and project management within the blockchain industry. Previously, I worked as a marketer for Woo Network and served as a project manager for several blockchain projects, including Gamee (Animoca), Chiliz, Pastel Network, Alium, MyDeFiPet, and Seascape. Currently, I am passionately involved in a pet project called CoinScouts. The primary goal of CoinScouts is to provide traders with better information and insights about different projects in the cryptocurrency space.

🔴 LATEST POSTS

- Binance’s Strategic Shift: Withdrawing Cryptocurrency Exchange Applications Amid Changing Regulatory Landscape

- Can I Mine Cryptocurrency On My Laptop?

- Can You Mine Cryptocurrency On Your Smartphone?

- Bitcoin’s Summer Standstill: Will the Cryptocurrency Market Ignite or Plunge?

- Worldcoin: Where Crypto Meets the Iris Scan – Real IDs for the Real Deal!

Previous Articles:

- Binance’s Strategic Shift: Withdrawing Cryptocurrency Exchange Applications Amid Changing Regulatory Landscape

- Can I Mine Cryptocurrency On My Laptop?

- Can You Mine Cryptocurrency On Your Smartphone?

- Bitcoin’s Summer Standstill: Will the Cryptocurrency Market Ignite or Plunge?

- Worldcoin: Where Crypto Meets the Iris Scan – Real IDs for the Real Deal!