- Fidelity Investments has filed with the SEC to register a blockchain-based version of its Treasury money market fund, with the product expected to go live May 30, pending regulatory approval.

- The fund will initially use the Ethereum network but may expand to other blockchains in the future, joining competitors BlackRock and Franklin Templeton in the tokenized Treasury market.

- The overall tokenized U.S. Treasury market has grown nearly 500% in the past year to $4.77 billion, signaling increasing institutional adoption of blockchain for traditional financial assets.

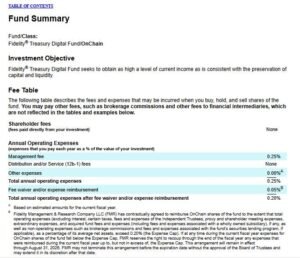

Fidelity Investments, the $5.8 trillion asset management giant, is making its move into tokenized real-world assets with a blockchain-based version of its U.S. Treasury money market fund. According to regulatory documents submitted Friday, the company aims to create an “OnChain” share class of its recently launched Fidelity Treasury Digital Fund (FYHXX).

The proposed tokenized fund, detailed in a filing with the Securities and Exchange Commission, would utilize blockchain technology as a transfer agent system. Initially, Fidelity plans to deploy the fund on the Ethereum network, though the filing indicates the company may expand to additional blockchain platforms in the future.

Subject to regulatory approval, the new tokenized share class is expected to become available on May 30. The underlying FYHXX fund, which invests in cash and U.S. Treasury securities, was introduced in late 2023.

This initiative comes amid a surge in traditional financial institutions tokenizing real-world assets (RWAs) on blockchain networks. These institutions are attracted by potential operational efficiencies, reduced settlement times, and 24/7 trading capabilities that blockchain technology offers.

Fidelity isn’t the first major player to enter this space. BlackRock, in collaboration with digital asset firm Securitize, launched its tokenized Treasury bill fund called BUIDL last March. That fund has emerged as the market leader with approximately $1.5 billion in assets under management, according to rwa.xyz data.

Franklin Templeton pioneered this category in 2021 with the first on-chain money market product, which has since accumulated $689 million in assets.

The entire tokenized U.S. Treasury market has experienced remarkable growth, expanding by nearly 500% over the past year to reach $4.77 billion in total market value, per rwa.xyz statistics.

Fidelity has already established itself as a significant player in the cryptocurrency investment space. The firm is among the largest issuers of spot cryptocurrency ETFs in the United States, with its Bitcoin ETF (FBTC) managing $16.5 billion and its ether ETF (FETH) holding $780 million in assets, according to SoSoValue data.

The move to tokenize Treasury products represents Fidelity’s expanding strategy to bridge traditional finance with blockchain technology, providing institutional investors with familiar assets in a modernized infrastructure.

✅ Follow BITNEWSBOT on Telegram, Facebook, LinkedIn, X.com, and Google News for instant updates.

Previous Articles:

- Crypto Misinformation Persists Despite Onchain Data, Analyst Warns

- Crypto Security Battle: Wallet Firms vs. Hackers in Deadlock, Says Ledger

- Gold-Backed Stablecoins Could Challenge USD Dominance, Says Max Keiser

- Russian Man Arrested in India for $152B Cryptocurrency Money Laundering

- Crypto Billionaire McCaleb Invests $1B in Space Station to Replace ISS