A month ago, I wrote that large entities operating behind the scenes were influencing Bitcoin’s price action and that retail traders were getting caught in the tide.

I said they wanted to shake out retail and buy Bitcoin cheap. Not at $125K.

Now I know who did it.

The sequence between Bitcoin’s October crash and January recovery looks like a planned setup. The data supports it. Two companies sit at the center: MSCI and Morgan Stanley.

One controls which stocks get included in the world’s most followed indexes. The other just filed to launch Bitcoin ETFs.

They announced major decisions on the SAME day.

That’s damn suspicious.

October 10: The Trigger

On October 10, 2025, MSCI dropped a bomb on crypto markets.

The company announced a consultation proposal to exclude Digital Asset Treasury Companies (DATCOs) from its Global Investable Market Indexes.

FYI, DATCOs are companies that hold Bitcoin or crypto as their main treasury asset. Strategy (formerly MicroStrategy), Metaplanet, and 37 other firms were named.

“Why does this matter?”

MSCI isn’t some small player.

Funds worth over $18.3 trillion follow MSCI indexes when deciding what to buy and sell.

This is called index benchmarking = when investment funds copy an index’s holdings to match its performance.

When MSCI says a company doesn’t belong in its indexes, pension funds, ETFs, and institutional portfolios have to sell.

The proposal set a threshold – Any company with 50% or more of assets in digital assets could be removed. The rationale was that these firms operate more like investment funds than operating businesses.

The market reaction was immediate.

Bitcoin dropped approximately $12,000 in hours.

More than $19 billion in crypto leverage was liquidated in a single day, according to FTI Consulting.

Leverage liquidation = forced selling of borrowed positions when prices move against traders.

The total crypto market lost hundreds of billions in value.

This wasn’t a random crash. It had a specific cause, a specific date, and a specific beneficiary waiting in the wings.

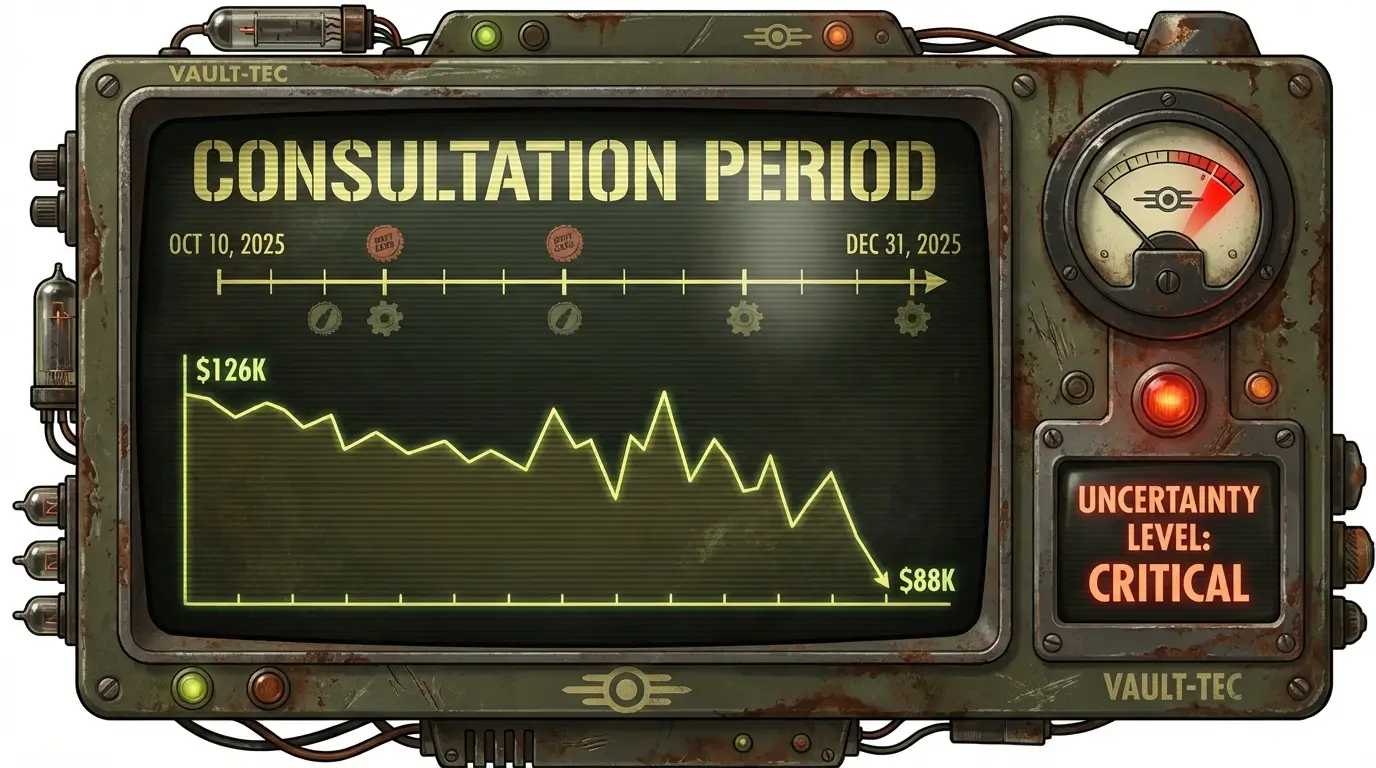

The 90-Day Pressure Window

MSCI’s consultation period ran from October 10 to December 31, 2025. That’s nearly three months of uncertainty.

During this window, institutional investors faced a problem.

If they held Strategy or other DATCOs, they risked forced selling in February 2026 when the exclusions would take effect. The rational move was to reduce exposure early.

JPMorgan analysts estimated that Strategy alone faced up to $2.8 billion in potential outflows.

If other index providers followed MSCI’s lead, total forced selling could reach $8.8 billion to $15 billion across affected companies.

The effects were predictable:

- Passive investors avoided exposure.

- Index-linked funds prepared for potential rebalancing = adjusting their holdings to match index changes.

- Prices stayed weak. Sentiment collapsed.

Bitcoin dropped from its October high near $126,000 to under $88,000 by year end.

According to CoinGlass data, Q4 2025 delivered a -23.07% return for Bitcoin, its second-worst quarterly performance in history and the worst since 2018. Altcoins fell harder, with Ethereum down 28%.

Some called it a bear market. I called it a setup.

Early January: The Suspicious Pump

Then something strange happened.

Starting January 1, 2026, Bitcoin began pumping. No major news. No regulatory announcements. No ETF approvals.

According to Yahoo Finance historical data, Bitcoin opened 2026 at approximately $87,500. By January 5, it reached $93,882.

That’s a 7%+ gain in five days.

Green candles (price increases) appeared back-to-back. The relentless selling that had defined Q4 2025 suddenly stopped.

“Where did this buying come from?”

Someone knew something. The timing suggests insiders positioned themselves before the announcements that came days later.

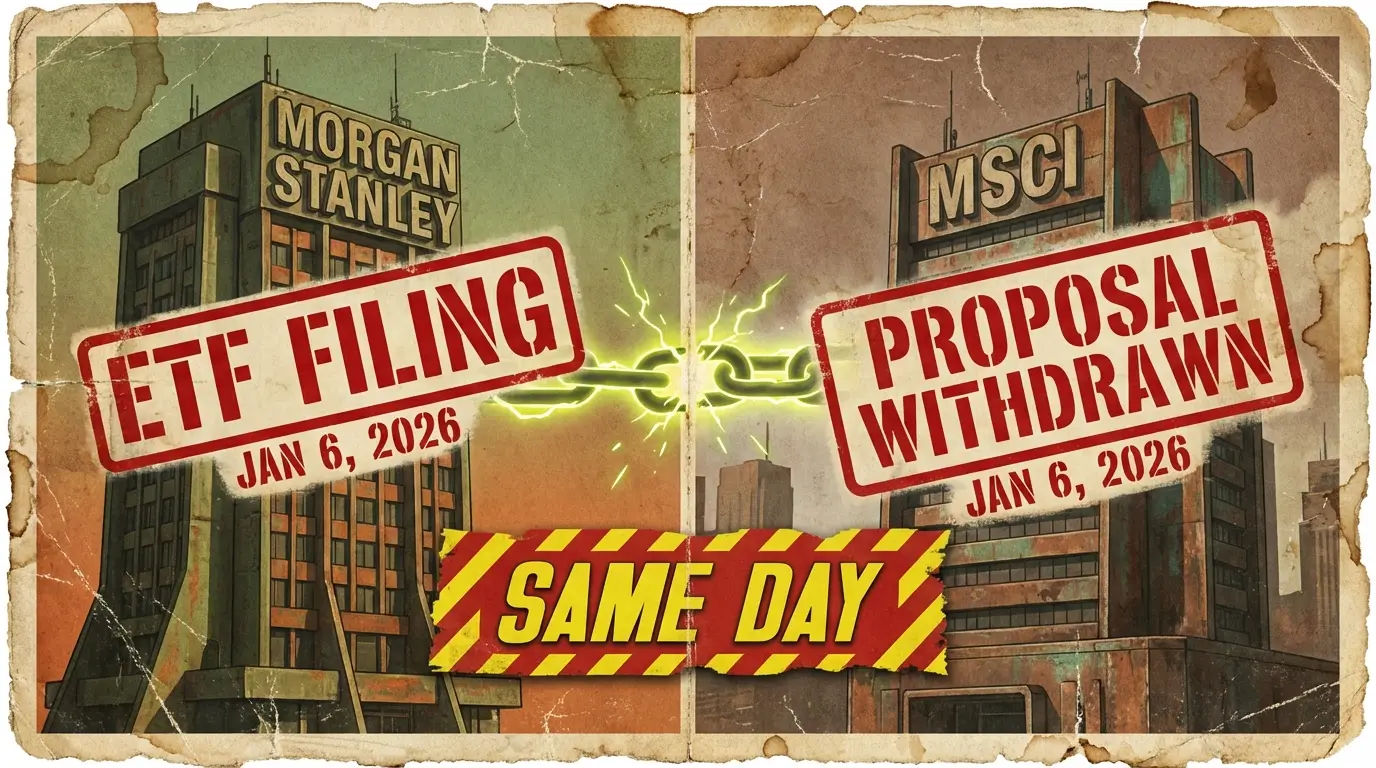

January 5-6: The Double Reversal

On January 6, 2026, two things happened within hours of each other.

- Morgan Stanley filed with the SEC to launch spot Bitcoin, Ethereum, and Solana ETFs. This was the first such move by a major U.S. bank. According to Reuters, the filings aimed to “deepen its presence in the cryptocurrency space.”

- The same day, MSCI announced it would NOT proceed with excluding DATCOs from its indexes.

Read that sequence again.

The exact rule that caused three months of selling pressure was suddenly withdrawn. The SAME day. That Morgan Stanley launched products. That BENEFIT from a recovering market.

“You realize what this means, right?”

ETF issuers must actually hold the underlying assets.

When Morgan Stanley launches a spot Bitcoin ETF, it needs to buy Bitcoin. A lot of it.

It was much cheaper to fill those ETF pockets at $85,000 than at $125,000.

The 90-day pressure window created the discount. The January reversal captured the profits.

The Morgan Stanley-MSCI Connection

Most people don’t know that MSCI stands for Morgan Stanley Capital International.

The company originated as a division of Morgan Stanley in 1986. In 2007, Morgan Stanley spun off MSCI via IPO. By 2009, Morgan Stanley had fully divested its stake.

They are legally separate entities today. But institutional relationships don’t disappear because of stock sales. People who worked together for decades don’t forget each other’s phone numbers. Information flows through networks that don’t show up on org charts.

I’m not claiming there’s a smoking gun memo. But when two companies with deep historical ties make coordinated announcements that benefit one of them directly, the burden of proof shifts.

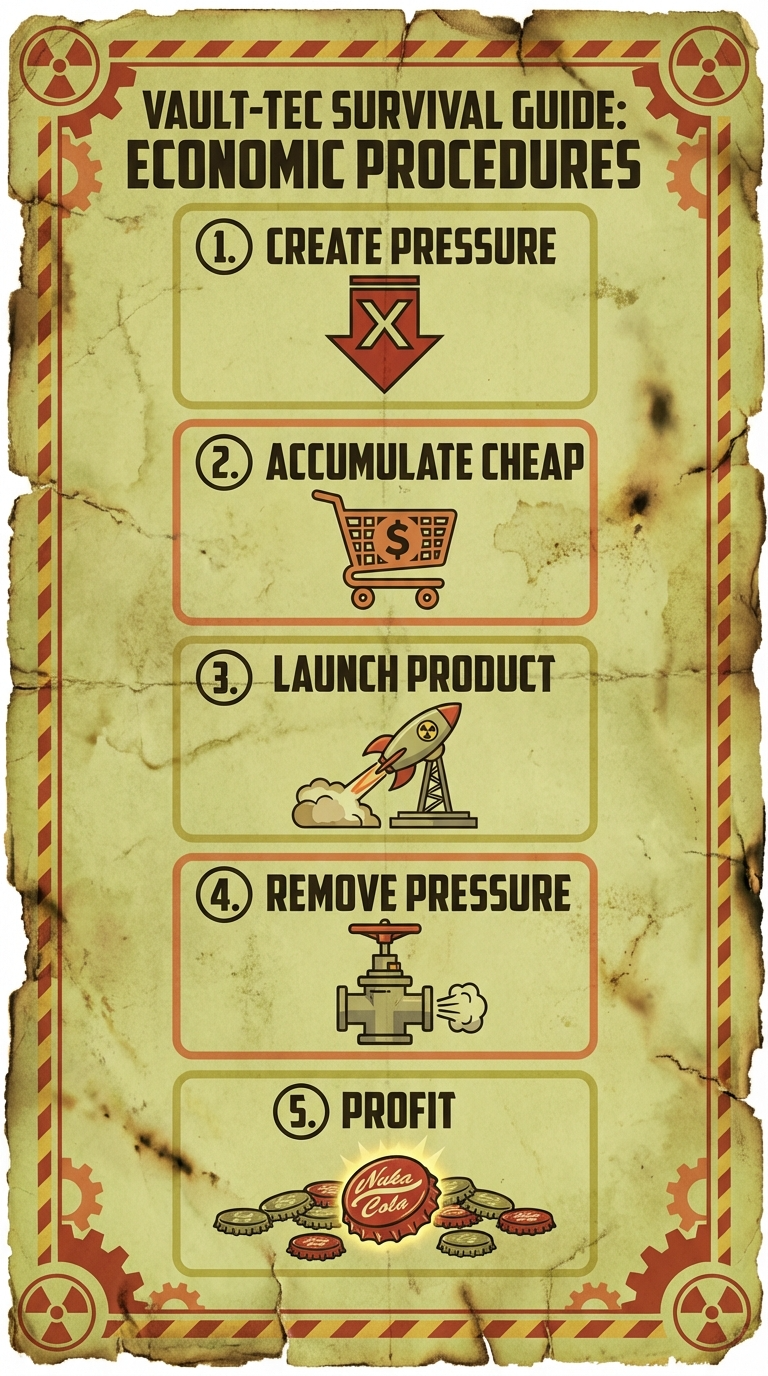

The Pattern Laid Bare

The timeline in order:

- October 10, 2025: MSCI proposes excluding crypto treasury companies from indexes.

- October-December 2025: Bitcoin crashes 27% from ATH. $19 billion in leverage liquidated. Sentiment turns bearish.

- December 31, 2025: MSCI consultation period closes.

- January 1-5, 2026: Bitcoin pumps 7% on no news.

- January 6, 2026: Morgan Stanley files for Bitcoin, ETH, and Solana ETFs.

- January 6-7, 2026: MSCI announces it will NOT exclude crypto treasury companies.

The pattern:

- Create pressure

- Accumulate at low prices

- Launch product

- Remove pressure

- Profit

MSCI controls index inclusion. Morgan Stanley controls capital distribution. Together, they can influence how and when institutional money reaches Bitcoin.

This is what a wealth transfer from retail to institutions looks like. Whale accumulation happens when prices are suppressed. Retail panic sells. Institutions buy the discount. Then the pressure lifts.

New Share Rules

MSCI didn’t completely back off. They added a new rule that limits future upside for treasury companies.

When DATCOs issue new shares, MSCI will not add those shares to its index calculations.

Previously, when Strategy or similar companies issued shares, index funds tracking MSCI benchmarks had to buy proportionally.

More shares issued = automatic buying demand from passive funds = easy capital raises.

That automatic buying demand is now gone.

For treasury companies, this means share dilution becomes less attractive. Less capital raised through equity. Slower Bitcoin accumulation.

This is why the market isn’t going vertical despite the good news. The threat was removed, but the growth engine was also capped.

What This Means For You

There is no official confirmation that MSCI and Morgan Stanley coordinated their actions. I have no access to internal communications. I’m not making legal accusations.

But the sequence, the timing, and who benefited raise questions that deserve answers.

Retail traders got liquidated in October while institutions waited. The same players who may have engineered the pressure are now positioned to profit from the rebound.

“So what do you do with this information?”

You can cry about manipulation. Or you can understand it and position accordingly.

Large institutions move markets. They have information advantages, capital advantages, and coordination advantages. They always have. The difference now is that the patterns are visible if you know where to look.

When index providers announce consultations, pay attention. When the consultation window closes, watch for reversals. When major banks file new products, ask yourself: who benefits from recent price action?

The Lesson

All the people crying that crypto is dead missed the point. They couldn’t see through the noise. They didn’t understand that the manipulation IS the signal.

The October crash wasn’t random market panic. It was structural.

The January recovery wasn’t organic demand. It was anticipated.

The players who understand this game profit. The players who don’t become exit liquidity = the people who sell at the bottom so institutions can buy cheap.

Which one are you going to be?

Note: This analysis represents my interpretation of publicly available information. The connections drawn are speculative. Always do your own research and never invest more than you can afford to lose.

Previous Articles:

- Retail Poll: SpaceX Most Anticipated 2026 IPO, 59% Lead—Poll

- Morgan Stanley Bitcoin ETF Pursuit Aims for Clout, Not Size.

- Senate ag, banking committees must align crypto oversight…

- Anthropic raises $10B, targets $350B valuation, IPO in 2026.

- Trump ally World Liberty seeks OCC trust charter for USD1…