In 2024, the global crypto market saw a massive upswing, surging by 97.7% and reaching a high of $3.91 trillion by December. This momentum is expected to carry forward into 2025.

TABLE OF CONTENTS

However, trading crypto derivatives isn’t always straightforward, especially for Indian users who often deal with challenges like currency conversion, limited liquidity, and restricted access to global platforms.

That’s where Delta Exchange comes in, offering one of the most seamless and reliable platforms for trading crypto futures and options. Delta delivers a solid trading experience with advanced tools, competitive pricing, and INR-based transactions for added convenience.

Let’s dive into what makes Delta a standout platform and how it simplifies crypto F&O trading.

FIU-Registered: Trade with Confidence on Delta Exchange

Delta Exchange is a well-known crypto derivatives platform, offering a seamless experience for traders looking to explore crypto futures and options. What sets it apart is its registration with India’s Financial Intelligence Unit (FIU), which adds a strong layer of trust and regulatory compliance, something especially important for new users entering the space.

Originally popular among global traders, Delta is now building a strong foothold in the Indian market. The platform creates a secure and regulated environment where users can trade with confidence. It also simplifies transactions for Indian traders by supporting easy deposits and withdrawals in INR, removing the typical hassles of currency conversion.

Delta provides access to a wide variety of crypto derivative markets, enabling traders to diversify and experiment with different strategies. Despite the complexity often associated with futures and options, the platform’s user-friendly interface ensures that both beginners and experienced traders can navigate it with ease.

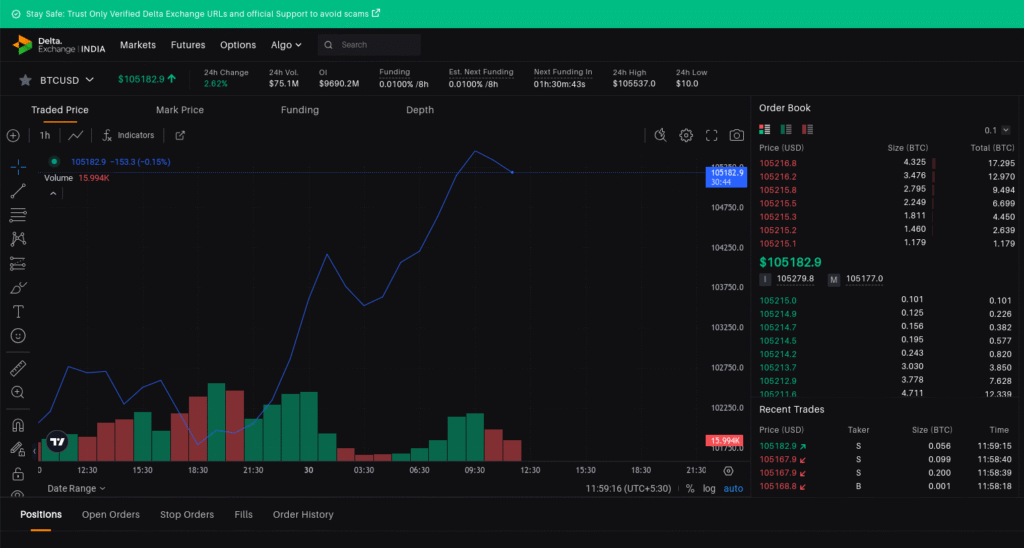

One of the most remarkable indicators of Delta’s performance is its daily trading volume, which hovers around $3 billion. This not only highlights the platform’s ability to handle high-frequency trading but also reinforces its reputation as a reliable choice for serious crypto traders.

Features & Benefits of Crypto F&O Trading

Delta Exchange is the best platform for crypto options trading in India. Here’s why:

1. INR Compatibility

One of the standout benefits of using Delta Exchange for Indian traders is its support for INR transactions. While many international platforms require users to convert their funds into stablecoins like USDT before trading, Delta eliminates that extra step. By allowing direct deposits and withdrawals in Indian Rupees, it not only reduces forex conversion fees but also streamlines the entire trading process for users based in India.

2. Wide Range of Crypto Derivatives

The platform also offers an impressive variety of crypto derivatives for crypto futures and options trading. Whether you’re interested in trading Bitcoin, Ethereum, Solana, or other major cryptocurrencies, Delta gives you access to an extensive list of options. Traders can also choose contracts based on different timeframes, daily, weekly, or monthly, offering the kind of flexibility needed to tailor trades to individual strategies and risk preferences.

3. Advanced Trading Tools

Enhance your crypto futures and options trading experience with:

| Feature | Description |

| Trading Bots | Automate your trading strategies with ease |

| Deep OTM/ITM Contracts | Trade deep in-the-money and out-of-the-money options |

| Strategy Builder | Create trading strategies with a simple interface |

| Basket Orders | Execute multiple trades simultaneously while optimizing margin |

| 24/7 Customer Support | Get help anytime you need it |

4. Affordable Entry Costs

Delta allows traders to start with small lot sizes, making crypto options trading more accessible. BTC contracts start from ₹5000 and ETH contracts from ₹2500. This means that whether you’re a beginner or a professional, you can trade based on your budget.

5. High Leverage (Up to 100x)

Leverage gives you the ability to open bigger trades than the amount you’ve put in. On Delta Exchange, you can use leverage of up to 100x on perpetual futures contracts. Investing ₹1,000 with 100x leverage allows you to control a position worth ₹1,00,000 in Bitcoin. This significantly increases your profit potential, but it also comes with higher risk. That’s why many traders use stop-loss orders to limit possible losses and protect their investments.

How to Trade Crypto Futures and Options on Delta Exchange

Getting started on Delta is straightforward. Follow these steps:

- Visit Delta Exchange

- Sign up with your details

- Deposit INR into your account

- Trade crypto futures and options on BTC, ETH, and more

- Withdraw funds in INR easily

For a more convenient experience, you can also download the Delta Exchange app on an Android or iOS device and trade on the go!

Conclusion

India is rapidly emerging as a major hub for crypto activity, with more traders on the lookout for safe and efficient platforms. Delta Exchange stands out by offering INR support, high liquidity, powerful trading tools, and integrated risk management, making it a dependable crypto exchange in India for anyone interested in trading crypto futures and options.

For those wanting a reliable crypto derivatives platform that simplifies trading, Delta Exchange is definitely a platform to explore.

Disclaimer: Crypto trading involves significant risks due to volatility. Please conduct thorough research before investing.

FAQs

What is Delta Exchange and how is it different from other crypto trading platforms?

Delta Exchange is a crypto derivatives platform that allows users to trade futures and options on major cryptocurrencies like Bitcoin, Ethereum, and Solana. What sets it apart is its focus on the Indian market, offering INR support, FIU registration, and advanced tools designed for both new and experienced traders.

Is Delta Exchange registered or regulated in India?

Yes. Delta Exchange is registered with India’s Financial Intelligence Unit (FIU). This adds a layer of trust and regulatory assurance, especially for users concerned about compliance and safety while trading.

Can I deposit and withdraw in INR on Delta Exchange?

Absolutely. One of Delta’s biggest advantages for Indian users is its support for INR transactions. You can deposit and withdraw funds directly in Indian Rupees without needing to convert to stablecoins like USDT.

What types of crypto derivatives can I trade on Delta Exchange?

Delta offers a wide variety of futures and options contracts on cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and more. You can also choose contracts with daily, weekly, or monthly expiries based on your strategy.

This article was created in partnership with the featured company to share information about its products or services. Views, thoughts, and opinions expressed in this article belong solely to the author, and not necessarily to the author’s employer, organization, committee, or other group or individual. The content is based on provided details and should not be considered financial or investment advice. Readers are encouraged to do their own research before making any decisions.

Previous Articles:

- Judge Orders Anthropic to Explain AI-Fabricated Citation in Suit

- AFME Urges EU Action on DLT Settlement, Collateral Eligibility

- Bitcoin Soars Near Record as Zuckerberg and Trump Fuel Crypto Surge

- Strategy Could Become Top Public Equity with $59B Bitcoin Holdings

- France to Meet Crypto Firms After Spate of Kidnapping Attempts