In recent months, the crypto world has been abuzz with speculation and excitement surrounding the potential approval of Bitcoin spot Exchange-Traded Funds (ETFs) by the U.S. Securities and Exchange Commission (SEC).

A pivotal player in this unfolding drama is none other than BlackRock, the world’s largest fund manager, with a staggering $10 trillion in assets under its purview.

As anticipation mounts, Wall Street is closely watching how BlackRock’s involvement could reshape the cryptocurrency landscape.

BlackRock Fuels Crypto Interest

BlackRock’s massive footprint in the financial industry cannot be understated. With the firm’s significant influence and reach, its support for cryptocurrencies has driven a surge of interest in Bitcoin and crypto assets on Wall Street.

Notably, this support has played a role in the remarkable 70% increase in Bitcoin’s price this year alone.

SEC’s Crucial Role in ETF Approval

The SEC, the regulatory watchdog of the U.S. financial markets, holds the key to the introduction of Bitcoin spot ETFs.

Notably, the SEC is expected to approve all spot Bitcoin ETF applications simultaneously, a development that many industry experts believe is imminent.

Former BlackRock managing director Steven Schoenfield is among those who anticipate SEC approval within three to six months.

Interestingly, rather than outright rejecting applications, the SEC has opted to delay decisions on prominent Bitcoin spot ETF applications until early next year.

This shift in approach, coupled with a request for comments, signals a potentially positive change in the regulatory dialogue.

Notably, U.S. lawmakers have instructed the SEC to reexamine Greyscale’s application to convert its Bitcoin trust into a fully-fledged Bitcoin spot ETF, highlighting the growing acceptance of digital assets.

Market Anticipation Reaches Fever Pitch

The entire crypto market is now on tenterhooks, eagerly awaiting the SEC’s verdict on Bitcoin spot ETFs.

Asset managers are already taking proactive steps to adapt their offerings, anticipating a seismic shift in the market’s response.

Smaller providers, including Valkyrie and VanEck, are diversifying their investments, expanding beyond Bitcoin into Ethereum.

Diversification into Ethereum provides these providers with an added selling point, ready to capture the attention of institutional players once Bitcoin ETFs become a reality.

The anticipation of this landmark development has led some to describe the current state of the market as akin to “holding one’s breath” in the lead-up to a potential earthquake in the Wall Street crypto market.

Price Uncertainty and Market Dynamics

The impact on Bitcoin, Ethereum, and XRP prices remains uncertain. While Bitcoin experienced a notable rebound this year, contributing to a rally in Ethereum and XRP prices, the market lost ground following BlackRock’s Bitcoin spot ETF filing.

Traders and investors are eagerly awaiting the SEC’s approval, with the potential for prices to surge significantly.

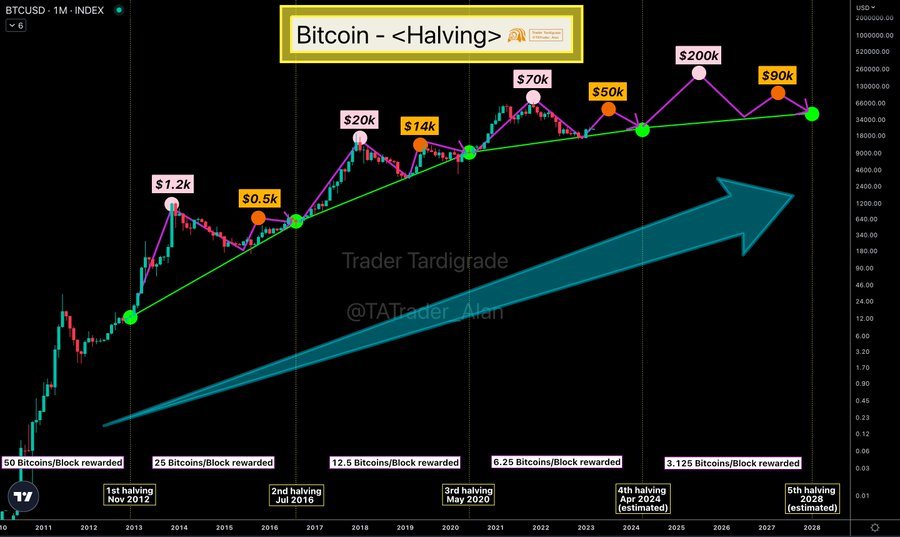

However, the approval of a Bitcoin spot ETF could also introduce price volatility, given Bitcoin’s historical halving events.

The market is currently in a state of suspense, with uncertainty regarding the future direction of prices until the SEC reaches its decision.

Institutional Players Prepare for Entry

Once the SEC gives the green light to Bitcoin spot ETFs, institutional players are expected to flood the market.

Asset managers are gearing up for this influx, knowing that competition will be fierce. Smaller providers like Valkyrie and VanEck are positioning themselves to attract institutional investors, potentially reshaping the dynamics of the Bitcoin ETF market significantly.

The interplay between BlackRock’s influence, the SEC’s impending decisions, market reactions, and the looming entry of institutional players has created a perfect storm of anticipation and uncertainty in the crypto world.

The months ahead promise to be transformative for the cryptocurrency market, with the potential for significant upheaval and opportunity in equal measure.

Wall Street is poised to embrace digital assets like never before, and the world is watching closely.

🔴 LATEST POSTS

- FTX Hacker Moves Millions in Cryptocurrency, While Sam Bankman-Fried’s Trial Unfolds

- 18 Countries With No Privacy Laws According To UN (List)

- Friend.Tech Faces Security Crisis: Recent SIM-Swap Attacks Raise Concerns

- Presidential Candidate Javier Milei Criticizes Proposed Argentine Digital Currency

- The Shocking Revelation: Sam Bankman-Fried’s $5 Billion Trump Dilemma

Previous Articles:

- FTX Hacker Moves Millions in Cryptocurrency, While Sam Bankman-Fried’s Trial Unfolds

- 18 Countries With No Privacy Laws According To UN (List)

- Friend.Tech Faces Security Crisis: Recent SIM-Swap Attacks Raise Concerns

- Presidential Candidate Javier Milei Criticizes Proposed Argentine Digital Currency

- The Shocking Revelation: Sam Bankman-Fried’s $5 Billion Trump Dilemma