The international crypto-twitter community has been shaken by the withdrawal of $4.5 billion worth of Bitcoin from Binance exchange.

More specifically, according to data from on-chain data analysis company CryptoQuant, these are two transactions of 117,000 and 40,000 coins respectively.

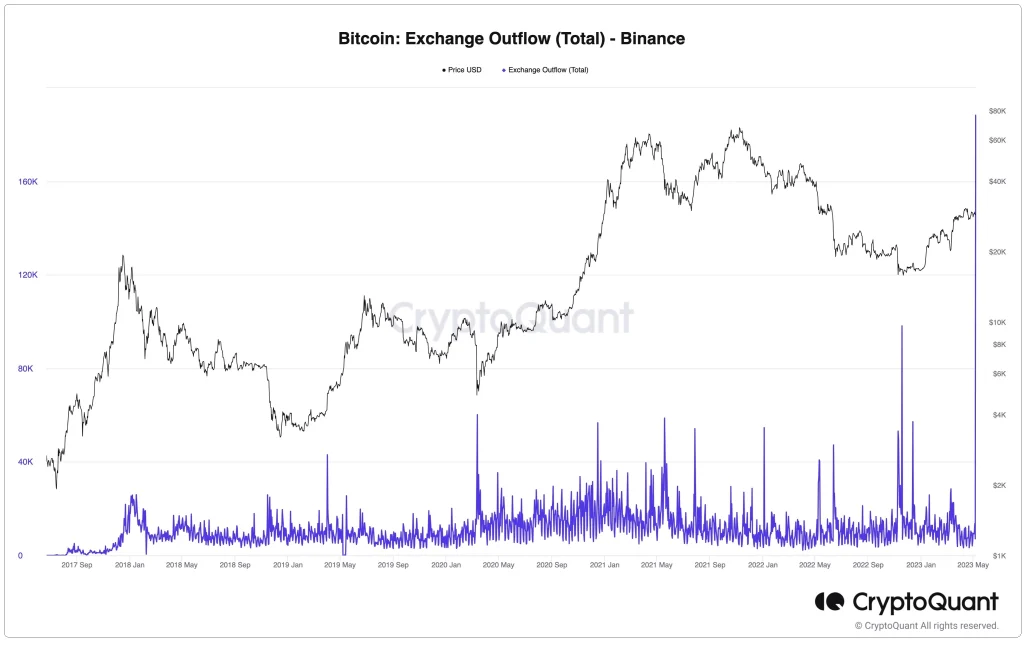

The transfers to different addresses drove Bitcoin outflows to a new all-time high for the world’s largest exchange by turnover, as the purple vertical line in the chart below reveals.

However, as explained by CryptoQuant’s head of the analysis team, Julio Moreno, there is actually no cause for concern. The Bitcoins were sent to two newly created addresses, both of which are owned by Binance. He even presented the proof on Twitter.

The transfers were made for security reasons. Excluding these two internal transfers, the remaining withdrawals were 10,000 coins. A typical daily turnover number.

The assumption that the huge movement of coins was not by “whales”, i.e. entities holding large numbers of Bitcoin, is also confirmed by Binance’s currency, BNB.

Under normal circumstances, it would be a positive sign to see bitcoin withdrawing from exchanges to personal wallets, as it shows the reluctance of holders to liquidate them in the near future. However, times are strange. With doubts about the reliability of exchanges approaching new highs after the FTX collapse, many have opted to keep their coins off platforms.

Indeed, as we can see in CryptoQuant’s chart, the previous big spike showing large amounts of withdrawals was in the period in question.

Bitcoin holders are taking advantage of the fact that it is a “naked” asset, which does not require third-party custodial services to hold it.

Just as it is with gold, only it is in digital form, not physical. It is transferred unhindered anywhere and anytime in the world. It is not constrained by sanctions, capital controls, bank runs or any other disadvantage of traditional banking.

READ NEXT

- Liechtenstein Embraces Bitcoin: Citizens Can Pay Taxes with Crypto, Government Eyes Bitcoin Investments

- What is Moon Tropica (CAH) – Technology, Tokenomics, Game Preview

- High-Risk Hedge Fund Investor Stanley Druckenmiller Sounds the Alarm on US Debt and Future Government Spending

- Bitcoin’s Halving: A Historical Indicator for Upward Trends in Price

- Curve Finance to Launch crvUSD Stablecoin in Ethereum Network

Previous Articles:

- Liechtenstein Embraces Bitcoin: Citizens Can Pay Taxes with Crypto, Government Eyes Bitcoin Investments

- What is Moon Tropica (CAH) – Technology, Tokenomics, Game Preview

- High-Risk Hedge Fund Investor Stanley Druckenmiller Sounds the Alarm on US Debt and Future Government Spending

- Bitcoin’s Halving: A Historical Indicator for Upward Trends in Price

- Should You Invest In Bitcoin In 2023?