The favorite topic of many economic analysts lately has been the attempts of many countries to disengage from the dollar.

Indeed, as we have argued, this is the first time that the dominance of the US currency is being challenged so openly and by so many.

However, it is clear from the beginning that we are still far from having the dollar “pushed into the canoe”. This is not an immediate and painless process, even if the goal of de-dollarization is finally achieved at some point in the future.

Global dominance of a currency is a long process. The dollar, to replace the pound sterling, has taken the end of the Second World War to achieve, even though the US economy had outstripped that of Great Britain as early as 1880.

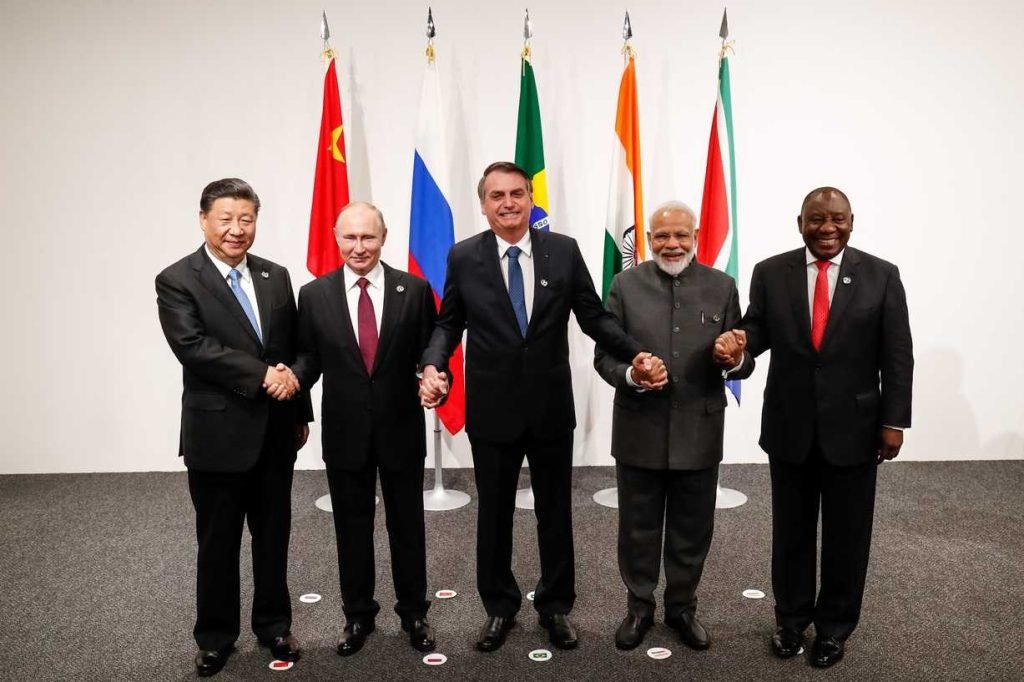

Especially when the BRICS currency, which for many will emerge from an alliance of disparate countries and interests, whose only essential common ground is the attempt to overthrow the established American power.

The problem of trust

To achieve such a project, it will have to start from the basics. The countries that are allied must come together. But right off the bat we see two of the major powers unwilling to cooperate and make deals that do not favor their narrow national interests.

As reported by Reuters, a week ago India and Russia suspended efforts to settle the mode of payment in trade between them after months of negotiations. The Indians failed to persuade the Russians to keep rupees in their coffers.

Although Indians buy cheap oil and coal from Russia, they import more goods than they export to Russia. In particular, it is estimated that the Russian trade surplus will reach $40 billion in value, which the Indians want to pay in their own currency.

This is something the Russians refuse to accept, as they already have several billion dollars in rupees deposited in Indian banks.

They want to be paid at least in Chinese yuan. They also want to convert those they already hold into other currencies.

There are basically two reasons.

- The first is the availability of Indian currency. They have nothing to do with the rupees. India’s share of world merchandise exports is just 2%. Hence they are useless to them.

- The second is about the risk of devaluation of the Indian currency or uncontrolled printing on the part of India. That is, the risk that currencies that have nowhere to use them in international trade will lose their value.

The Indians in turn do not want to pay Russia in US dollars. Apart from the well-known geopolitical reasons, they fear that they may face sanctions.

Moreover, they are reluctant to pay in rubles because they are not at all sure they will get it on world markets at a fair rate, Indian sources told Bloomberg last month.

The dollar and gold solution

The dollar is being used to address precisely these problems of international trade. That is why it has dominated as the world’s reserve currency, not because it was necessarily imposed by the Americans.

It suited them all because it has the advantages of wide acceptance in world trade, reliable stability and dispersed quantity around the world.

These are the reasons why there are many willing nations that accept it in exchange for their own goods and their central banks prefer to hold it as the main currency in their foreign exchange reserves.

Alternatively, the next reliable option is gold, which has the disadvantage of being heavy, cumbersome and expensive to store.

This was, after all, the reason why banknotes were used, even in periods when they have a locked exchange rate with gold. It may be that anyone who held paper money ran the risk of not being able to eventually convert it into gold and finding themselves at a loss, but the need to make transactions easy prevailed.

The next reserve currency candidate

Which has the necessary qualifications in the future to become the dominant global reserve currency, possessing the scarcity of gold and the ease of electronic transfer?

But not the current one, with its small capitalization and still low adoption rate, but a strong, widespread Bitcoin.

What advantage does Bitcoin have that can be developed into a reserve currency?

First of all, it is neutral. It is not owned by any state, by any company, issued by any central bank. It is acquired by anyone who wishes to spend resources to create it.

Anyone, literally anyone, without even having it on their own territory, as is the case with gold.

It is more rare than all commodities (and than gold), along with the advantage of being very small and precisely subdivided. It is also safer to store and faster to trade.

I can send it to thousands of locations in seconds. No matter how large the amount, wherever I want in the world. It’s both portable and indestructible.

They call it digital gold because it’s the dematerialization of gold.

Like Google digitized the library, Apple digitized the camera, Facebook digitized the coffee shop and exploded their capabilities. What else is on the horizon with these properties? Nothing. Only Bitcoin.

What is it missing? Stability in parity and wider recognition. For now, it is an emerging, new store of value asset, not a mature one.

That’s why it has greater volatility than gold, which is protected by the glamour of thousands of years of history.

Bitcoin has peculiarities that we have never encountered before and that is why it is difficult to estimate its value. But every day more and more people are becoming aware of it and feel more confident holding it.

Someday, according to its fanatical supporters, Bitcoin will be the most boring stock market security. However, if they are right and it reaches that point, prices will be significantly higher than they are today.

READ NEXT

Previous Articles:

- BNB Chain Dominates Active Addresses, Solidifying Its Leading Position Among Blockchains

- Bittrex’s Fall from Grace: Regulatory Pressure and Intense Competition Lead to Bankruptcy

- LeBron James Rocks Exclusive Nike Sneakers, Unlocked Only Through Ethereum NFT Mining

- Solana Empowers ChatGPT: OpenAI’s Chatbot Gains Access to Solana Blockchain Functions

- Crypto-Twitter Reacts: $4.5 Billion Worth of Bitcoin Withdrawn from Binance Exchange