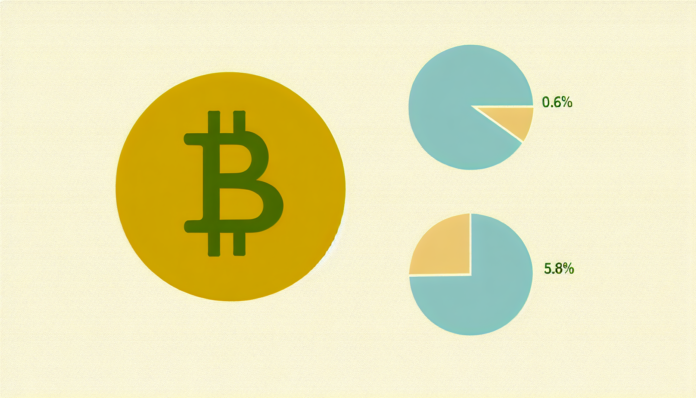

- Bitcoin‘s current $2 trillion market cap represents only 0.58% of global financial assets, suggesting substantial growth potential.

- Price movements are primarily driven by demand and access improvements rather than mining supply dynamics.

- The 1MB block size decision positioned Bitcoin as digital Gold rather than a payment network.

- Network effects differentiate Bitcoin from traditional gold, following an S-curve adoption pattern.

- Portfolio optimization suggests increasing Bitcoin allocation from 0.58% to 5.77% could boost returns from 11.3% to 14.1%.

Bitcoin Investment Framework Points to Higher Institutional Allocations

Recent analysis indicates institutional investors should consider increasing their Bitcoin holdings to 5.77% of portfolios, up from the current market average of 0.58%, based on modern portfolio theory and network adoption metrics.

Digital Gold’s Market Position

Bitcoin’s potential market capture extends beyond its current $2 trillion valuation. Analysis shows the digital asset could penetrate segments of the $10 trillion addressable market, including private investments ($4 trillion), central bank reserves ($3.1 trillion), and industrial applications ($2.7 trillion).

The cryptocurrency’s price movements stem primarily from institutional access improvements rather than mining supply changes. Each bull market has coincided with new financial products, from basic spot exchanges to recent SEC-approved ETFs and derivatives.

Portfolio Integration Strategy

Investment managers applying the Black-Litterman optimization model – a mathematical framework for portfolio allocation – should evaluate three primary factors:

- Bitcoin’s performance versus equity markets

- Equity-to-bond return ratios

- Overall portfolio volatility targets

Mathematical modeling shows that with Bitcoin projected to outperform U.S. stocks by 30% in 2025, and stocks exceeding bonds by 15%, an optimized portfolio targeting 12% volatility would adjust as follows:

- Equities: 19.1% to 24.9%

- Fixed income: 44.6% to 57.7%

- Real estate: 16.8% to 0%

- Alternatives (including Bitcoin): 19.5% to 17.4%

The 1-megabyte block size limitation, while restricting transaction throughput, reinforced Bitcoin’s position as a store of value rather than a payment network. This technical parameter, combined with regulatory clarity from the CFTC and SEC, has accelerated institutional adoption as Bitcoin reaches 0.58% of the $400 trillion global financial asset market.

✅ Follow BITNEWSBOT on Facebook, LinkedIn, X.com, and Google News for instant updates.

Previous Articles:

- Wall Street Giants Poised for Crypto Shopping Spree in 2025 as TradFi Flexes Muscle

- Bitcoin Bulls Eye Next Milestone as Industry Leaders Map 2025 Investment Landscape

- Bitcoin Staking Market Could Surge to Hundreds of Billions, Experts Forecast for 2025

- Musk’s ‘Kekius Maximus’ X Rebrand Sends Obscure Crypto Soaring 2,000%

- Chinese Banks Ordered to Monitor Crypto-Linked Forex Trades in Fresh Crackdown