QUICK NAVIGATION

Crypto markets never sleep. They’re wild, volatile, and can swing dramatically while you’re catching Z’s or binging your favorite shows. For newcomers, keeping up with this 24/7 market can feel like trying to drink from a fire hose.

Fear not, crypto trading bots are here – your digital trading assistants. These automated tools execute trades based on preset rules and strategies, even when you’re not glued to the charts.

For beginners especially, bots can be really helpful tools that remove some of the stress, emotion, and time commitment from crypto trading. Interestingly, we spoke to Invezz’s editor James Knight who wrote this article about Best Bitcoin Robots, and he said that we’re already in the era where bots can also trade markets.

In this article, I’m going to walk you through the 7 best beginner-friendly crypto trading bots that can help you start your automated trading journey.

You’ll discover which features matter most for newcomers, how to set realistic expectations (no, bots won’t make you an overnight millionaire), and how to take your first steps with confidence.

Quick Look: Top 3 Best Crypto Trading Bots

Want the TL;DR version before we dive deeper? Here are my top three recommendations after testing numerous platforms:

| Feature | 3C

3Commas | CR

Coinrule | PX

Pionex |

|---|---|---|---|

| Best For | All-Around Use | No-Code Setup | Built-in Exchange |

| Standout Feature | User-friendly interface & copy trading | Drag-and-drop strategy builder | Free built-in bots, no subscription |

| Pricing |

Free plan available Pro from $37/month |

Free plan available Paid from $29.99/month |

No subscription 0.05% trading fee |

| Get Started | Try 3Commas | Try Coinrule | Try Pionex |

What Exactly is a Crypto Trading Bot?

A crypto trading bot = software that automatically executes buy and sell orders based on predefined criteria.

Think of it as having a tireless assistant who follows your instructions to the letter.

These bots connect to exchanges through APIs (Application Programming Interfaces), which are secure connections that allow the bot to trade on your behalf without having full access to your funds.

For beginners, bots offer some serious advantages:

- Emotionless Trading: The bot doesn’t panic sell during dips or FOMO into pumps – it sticks to your strategy.

- Around-the-Clock Operation: Unlike us humans who need sleep, bots work 24/7, catching opportunities you might miss.

- Speed & Efficiency: Bots execute trades in milliseconds – much faster than manual trading.

- Strategy Testing: Many bots let you backtest strategies against historical data before risking real money.

- Learning Tool: Using bots can actually teach you about different strategies and market indicators.

- Time Freedom: Instead of constantly checking charts, you can focus on learning the markets while your bot handles the execution.

“But aren’t bots just for tech-savvy traders?”

Actually, no! Modern crypto bots are increasingly user-friendly, with many designed specifically with beginners in mind.

How I Chose These Trading Bots

Not all bots are created equal, especially when it comes to beginner-friendliness. Here’s what I look for in a bot that’s suitable for newcomers:

- User-Friendly Interface – This is non-negotiable. If you need a computer science degree to use the platform, it’s not beginner-friendly. Look for clean dashboards, visual strategy builders, and good mobile apps.

- Pre-set/Copy Trading Strategies – The ability to use ready-made strategies or copy successful traders is huge for beginners. This means you don’t have to create strategies from scratch while you’re still learning.

- Paper Trading/Demo Mode – This feature lets you practice with fake money before risking real crypto – an absolute must for beginners.

- Strong Security Measures – Your bot needs secure API connections (with withdrawal permissions disabled!), two-factor authentication, and a solid reputation in the community.

- Supported Exchanges – The bot should work with major reputable exchanges like Binance, Coinbase, and Kraken. More exchange options = more flexibility.

- Transparent Pricing & Free Trials – Beware of hidden fees. Good bots offer clear pricing tiers, with many providing free plans or trials so you can test the waters.

- Quality Support & Community – When you’re stuck (and trust me, you will get stuck at some point), responsive customer support and an active user community are priceless.

- Educational Resources – The best beginner bots include tutorials, strategy guides, and knowledge bases to help you learn while you earn.

Best Crypto Trading Bots for Beginners in 2025

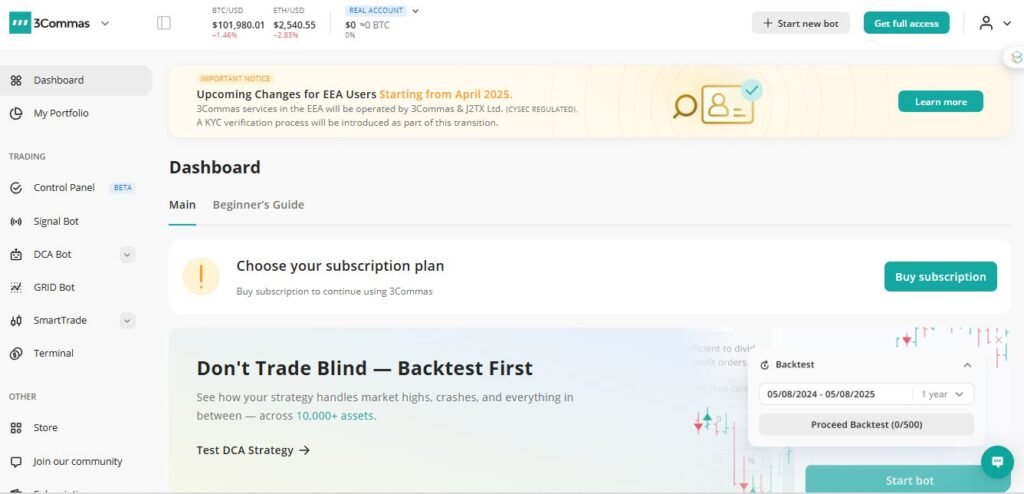

1. 3Commas

Why it’s great for beginners: Most comprehensive all-around platform with excellent user experience

3Commas consistently ranks at the top of crypto bot lists for good reason. After using it for the past year, I can confidently say it strikes the perfect balance between powerful features and user-friendliness.

Key Features for Newbies:

- SmartTrade terminal for executing complex orders simply

- Copy trading to replicate strategies from successful traders

- Paper trading mode to practice risk-free

- Grid and DCA (Dollar Cost Averaging) bots for different market conditions

Supported Exchanges: Works with 20+ exchanges including Binance, Coinbase Pro, Kraken, Bybit, and KuCoin

Pricing Snapshot: Free plan available with limited features; paid plans range from $37-59/month

Pros:

- Intuitive interface that’s easy for beginners to navigate

- Excellent mobile app for on-the-go monitoring

- Strong community and support resources

- Regular platform updates and new features

Cons:

- Some advanced features locked behind higher pricing tiers

- Can feel overwhelming at first due to the range of options

- Occasional lag during high market volatility

2. Coinrule

Why it’s great for beginners: Easiest no-code experience with a drag-and-drop interface

If coding sounds as appealing as a root canal, Coinrule might be your match. It uses a simple “if this, then that” approach to building strategies – no programming required.

Key Features for Newbies:

- Visual rule builder with drag-and-drop functionality

- 150+ template strategies ready to deploy

- Demo mode for testing strategies with virtual funds

- One-on-one trading sessions with experts (on higher plans)

Supported Exchanges: Integrates with Binance, Coinbase Pro, Kraken, and 7 others

Pricing Snapshot: Free starter plan available; paid plans from $29.99/month

Pros:

- Simplest strategy creation for absolute beginners

- Clean, intuitive interface with minimal learning curve

- Regular strategy templates updates based on market conditions

- Strong education section with webinars and tutorials

Cons:

- Limited customization compared to more advanced platforms

- Free plan restricted to $3K monthly volume

- Fewer advanced features than competitors

3. Pionex

Why it’s great for beginners: Built-in exchange with free trading bots

Pionex takes a unique approach by functioning as both an exchange and a bot platform. This means you don’t need to connect APIs – everything’s integrated.

Key Features for Newbies:

- 16+ free built-in bots including Grid, DCA, and Spot-Futures Arbitrage

- No subscription fees – just standard trading fees

- Simple setup process with user-friendly interface

- Mobile app for Android and iOS

Supported Exchanges: Is its own exchange (but sources liquidity from Binance and Huobi)

Pricing Snapshot: No subscription fee; flat 0.05% trading fee per transaction

Pros:

- No monthly subscription = cost-effective for beginners

- Simplifies the process by eliminating API connections

- Free bots with surprisingly robust features

- Low trading fees compared to many exchanges

Cons:

- Limited to trading on Pionex only

- Fewer advanced customization options

- Not available in some jurisdictions (including some US states)

4. Bitsgap

Why it’s great for beginners: Best demo mode and strategy testing

Bitsgap shines when it comes to letting beginners experiment risk-free. Their demo mode is the most comprehensive I’ve tested, making it perfect for those still learning the ropes.

Key Features for Newbies:

- Excellent demo mode with $100K virtual funds

- GRID, DCA, and COMBO bots for different strategies

- Smart Trade terminal with Take Profit and Stop Loss

- Portfolio tracking across exchanges

Supported Exchanges: Connects to 15+ exchanges including Binance, Kraken, and KuCoin

Pricing Snapshot: 7-day free trial; plans start at $49/month

Pros:

- Outstanding simulation environment for learning

- Clean, intuitive interface with helpful tooltips

- Robust backtesting capabilities

- Unified dashboard for managing multiple exchanges

Cons:

- No permanent free plan after trial ends

- Higher starting price point than some competitors

- Some advanced features have steeper learning curves

5. TradeSanta

Why it’s great for beginners: Simplest setup process for automated strategies

TradeSanta focuses on making the bot setup process as straightforward as possible, which is refreshing for beginners who just want to get started without extensive configuration.

Key Features for Newbies:

- Bot Wizard walks you through setup step-by-step

- Templates for quick strategy deployment

- Long and short bots for different market directions

- TradingView integration for custom signals

Supported Exchanges: Works with Binance, Bybit, HTX, and others

Pricing Snapshot: 3-day free trial; Basic plan starts at $25/month

Pros:

- Exceptionally easy bot creation process

- Clean, distraction-free interface

- Good mobile app for monitoring on the go

- Reasonable pricing tiers

Cons:

- No permanent free tier

- Fewer educational resources than some competitors

- Limited advanced customization options

6. WunderTrading

Why it’s great for beginners: Best TradingView integration for visual traders

If you’re already familiar with TradingView charts (or want to learn), WunderTrading offers the smoothest integration, turning TradingView strategies into automated bots.

Key Features for Newbies:

- Convert any TradingView alert into a trading bot

- Copy trading from successful traders

- Paper trading for risk-free practice

- DCA, GRID, and AI-powered bots

Supported Exchanges: Supports 16+ exchanges including Binance, Coinbase Pro, Bybit, and more

Pricing Snapshot: Free plan available; paid plans from $19.95/month

Pros:

- Seamless TradingView integration = visual strategy building

- Transparent performance tracking

- Clean, modern interface

- Strong social/copy trading features

Cons:

- Best features require TradingView knowledge

- Less intuitive for complete beginners

- Mobile app could use improvement

7. Cryptohopper

Why it’s great for beginners: Most comprehensive marketplace of ready-to-use strategies

Cryptohopper boasts the largest marketplace of pre-made strategies and signals, making it easy for beginners to implement professional approaches without creating their own.

Key Features for Newbies:

- Strategy Marketplace with hundreds of options

- Visual Strategy Designer (no coding required)

- Paper trading for practice

- External signal provider integration

Supported Exchanges: Works with 16+ exchanges including Binance, Coinbase, and Kraken

Pricing Snapshot: 7-day free trial; plans start at $19/month

Pros:

- Huge marketplace of ready-to-use strategies

- Drag-and-drop strategy builder

- Cloud-based (works even when your computer is off)

- Extensive backtesting capabilities

Cons:

- Interface can feel cluttered

- Strategy Marketplace has both free and paid options

- Higher pricing tiers for advanced features

Can you make “Passive Income” with Bots?

I get it – the dream of setting up a bot and watching money roll in while you sleep is tempting. That’s why “passive income” is plastered all over crypto bot marketing. But let’s have a reality check.

The Allure of Passive Income

Trading bots do offer a degree of automation that can reduce your active involvement. Once properly configured, they can:

- Execute trades without you watching the market

- Follow strategies 24/7

- Operate across multiple markets simultaneously

Why Bots Aren’t Magic Money Printers

Despite what some YouTube gurus might claim, bots have serious limitations:

- Market Volatility Still Applies: Crypto remains highly unpredictable, and bots can’t magically predict crashes or pumps.

- Setup and Monitoring Required: “Set and forget” = recipe for disaster. Successful bot trading requires initial setup, testing, and regular strategy adjustments.

- Strategies Become Outdated: What works in a bull market often fails in bear markets. Static strategies eventually stop performing.

- Losses Are Possible: Bots can and will lose money if markets move against their programming or if they’re poorly configured.

Realistic Expectations for Beginners

With the reality check out of the way, here’s a balanced perspective:

- Start With Learning, Not Earning: View bots initially as learning tools that help you understand markets and strategies.

- “Passive” = Less Active, Not Inactive: Successful traders check their bots daily and adjust as needed.

- Start Small: Begin with small amounts until you’re confident in your bot’s performance.

- Diversify Strategies: Don’t rely on a single bot or approach.

Red Flags: Bot Scams to Avoid

Be wary of:

- Bots promising specific return percentages (no legitimate bot can guarantee returns)

- Platforms requiring you to enable withdrawal permissions on API keys

- Services with no free trial, demo, or transparent pricing

- Bots with no community presence or verifiable track record

Your First Steps with a Crypto Trading Bot

Ready to dip your toes into automated trading? Here’s your roadmap:

Step 1: Choose Your Bot Wisely

Review the options above and select one that matches your needs, experience level, and budget. For absolute beginners, I recommend starting with 3Commas, Coinrule, or Pionex.

Step 2: Select a Compatible Exchange

Choose a reputable exchange that works with your selected bot. Binance, Coinbase Pro, and Kraken are solid options for beginners due to their liquidity and reliability.

Step 3: Securely Connect Your Bot

When creating API keys on your exchange, NEVER enable withdrawal permissions. Your keys should only have trading rights. Add two-factor authentication to both your exchange and bot accounts.

Step 4: Start with Paper Trading

Use the bot’s demo mode or paper trading feature to test strategies without risking real money. This is not an optional step for beginners – it’s essential!

Step 5: Implement a Simple Strategy

Begin with a straightforward approach like a basic grid bot or DCA strategy. Avoid complex setups until you understand how things work.

Step 6: Monitor, Learn, and Adjust

Check your bot’s performance regularly, learn from its trades (both successful and unsuccessful), and make adjustments as needed. Remember: the bot is a tool, not a replacement for your judgment.

Conclusion: Automate Your Trades, Not Your Diligence

Crypto trading bots offer beginners an accessible entry point into the world of automated trading. They can reduce emotional decisions, save time, and help execute consistent strategies. However, they’re not magic solutions or guaranteed profit generators.

The most successful bot traders I know understand that automation is a tool that complements their trading knowledge – not a substitute for it. They maintain a healthy level of involvement, continuously learn, and adjust their approaches as markets evolve.

If you’re just starting out, focus on learning how these tools work rather than chasing instant profits. Begin with small amounts, use paper trading extensively, and gradually expand as your confidence and knowledge grow. With patience and diligence, trading bots can become valuable allies in your crypto journey.

Which bot are you excited to try first? Share your thoughts or questions in the comments below!

FAQ

Are crypto trading bots profitable?

They can be profitable when properly configured and monitored, but there’s no guarantee. Success depends on your strategy, market conditions, and how actively you manage your bots. Consider them tools that can help execute strategies, not magical profit machines.

How much capital do I need to start with a bot?

You can start with as little as $100 on many platforms, though $500-1000 provides more flexibility for strategies like grid trading that benefit from wider price ranges. Start small and scale up as you gain confidence.

Are crypto trading bots safe to use?

Reputable bots from established providers are generally safe when used correctly. Key safety practices include: never enabling withdrawal permissions on API keys, using two-factor authentication, starting with small amounts, and sticking with well-known platforms. The bots themselves don’t hold your funds – your crypto remains on your exchange.

Can I lose money using a crypto trading bot?

Absolutely. Bots follow programmed instructions and can’t predict unexpected market movements. Poor configuration, strategy selection, or unusual market conditions can all result in losses. This is why starting small and using paper trading is so important.

Do I still need to understand crypto trading if I use a bot?

Yes! Understanding trading concepts, market analysis, and risk management remains essential. Bots are tools that execute strategies – they don’t replace the need for trading knowledge. The most successful bot users have solid trading fundamentals.

Previous Articles:

- CoreWeave Q1 Revenue Soars 5x, Losses Deepen Amid AI Surge

- Surfshark Launches Free Privacy-Focused DNS Service to Protect User Data

- Coinbase Eyes More Acquisitions After $2.9B Deribit Purchase

- Elon Musk’s Grok AI Under Fire for Spreading ‘White Genocide’ Claims

- Dogecoin Active Addresses Surge 528% as Futures Interest Soars 70%