As the world of cryptocurrency continues to evolve at an unprecedented pace, Australia is stepping up its efforts to regulate the burgeoning industry.

Treasurer Jim Chalmers has unveiled a comprehensive proposal that seeks to subject cryptocurrency exchanges and digital asset platforms to existing financial services laws, with the primary goal of reducing risks faced by Australian investors and fostering innovation in this rapidly expanding market.

Cryptocurrency Reforms in Australia

Under Chalmers’ proposal, platform operators will be required to obtain an Australian financial services license, bringing them under the purview of regulatory authorities.

These measures are designed to address the risk of platform collapses, which have in the past led to Australian investors losing their assets or facing significant delays in accessing them.

Specifically, the reforms will apply to platforms holding over $1,500 of an individual’s assets or $5 million in aggregate.

Chalmers’ reforms also include a review of minimum standards for digital assets such as tokens, a crucial step to elevate the safety and integrity of the cryptocurrency market.

These changes aim to ensure that digital currencies are traded and held in a secure and regulated environment.

Risks Faced by Australians in the Crypto Market

With billions of dollars held by online platforms, Australians have been exposed to significant risks in the crypto market.

Collapses of digital asset platforms have resulted in the loss of assets and financial uncertainty for investors.

The proposed reforms are aimed at lifting the standard of platform operations to prevent such collapses, protecting consumers, and providing a regulated framework in which innovation can flourish.

To ensure the proposed reforms consider various perspectives, feedback on the proposal paper can be submitted until December 1, 2023, reflecting the government’s commitment to a collaborative approach.

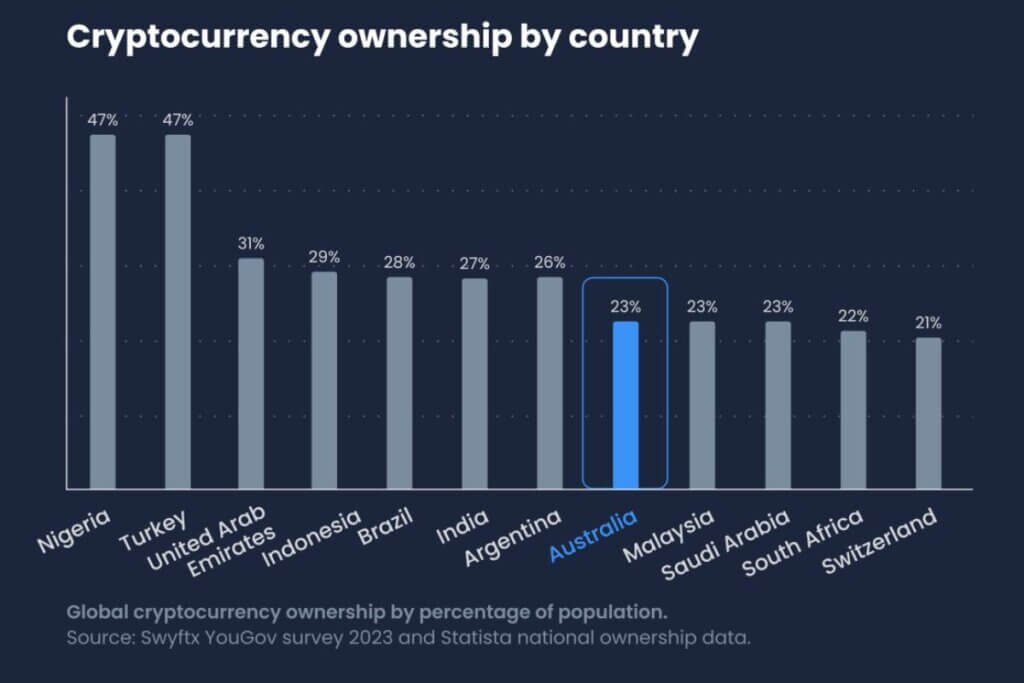

Ownership of Cryptocurrency in Australia

Approximately a quarter of Australians now own some form of cryptocurrency. These reforms represent a proactive effort by the government to protect the interests of this growing demographic of crypto owners.

The proposal paper underscores the need for adequate protection for those engaging in the digital asset market.

Consultation for draft legislation will continue into the following year, indicating a sustained commitment to safeguarding cryptocurrency owners.

Central Bank’s Evolving Views on Digital Currencies:

Assistant Governor Brad Jones, representing the Reserve Bank of Australia, emphasized the central bank’s open-minded approach to the functional forms of digital money and supporting infrastructure.

The RBA plans to publish a stocktake of its research into a central bank digital currency, in collaboration with the Treasury.

This approach underscores the potential savings and accountability that digital currencies can bring to Australia’s financial markets.

Challenges and Future Work in the Digital Currency Space

Despite the evident benefits of digital currencies, challenges remain. Regulatory uncertainty and compliance obligations must be addressed to facilitate widespread adoption.

Additionally, the complex nature of smart contracts on programmable ledgers necessitates clear accountability, particularly concerning cross-border and anti-money laundering responsibilities.

To overcome these challenges, policymakers and industry stakeholders must work together, fostering an environment that promotes responsible innovation and growth in the digital currency space.

More research and development are needed to address potential obstacles, and the Reserve Bank of Australia, along with the Treasury, remains committed to assessing and developing a central bank digital currency.

As Australia moves to enhance regulations in the cryptocurrency market, the government seeks to strike a balance between safeguarding investors and fostering innovation in this rapidly evolving sector.

These reforms, along with the Reserve Bank’s open-minded approach, represent a proactive effort to shape the future of digital currencies in the country.

🔴 LATEST POSTS

- The Bahamas Embraces Innovation and Regulation in Digital Finance

- Platypus DeFi Faces Third Exploit in 2023, Suspends Pools to Address Security Concerns

- USDC Tokens Go Native on Polygon: Faster, Cheaper, and Easier

- Solana’s Milestone 1.16 Update Introduces Confidential Transfers for SPL Tokens as SOL Holds Steady

- 26 Best Investment Audiobooks That Will Transform You Into a Savvy Investor

- Another Friend.tech User Loses $34,958 in Phishing Scam, Raises Alarm on Cryptocurrency Security

Previous Articles:

- The Bahamas Embraces Innovation and Regulation in Digital Finance

- Platypus DeFi Faces Third Exploit in 2023, Suspends Pools to Address Security Concerns

- USDC Tokens Go Native on Polygon: Faster, Cheaper, and Easier

- Solana’s Milestone 1.16 Update Introduces Confidential Transfers for SPL Tokens as SOL Holds Steady

- Another Friend.tech User Loses $34,958 in Phishing Scam, Raises Alarm on Cryptocurrency Security